![2025_TCR_Compliance_A_Definitive_Guide-1[1]](https://mytcrplus.com/wp-content/uploads/2026/02/2025_TCR_Compliance_A_Definitive_Guide-11-768x429.png)

![2025_TCR_Compliance_A_Definitive_Guide-2[1]](https://mytcrplus.com/wp-content/uploads/2026/02/2025_TCR_Compliance_A_Definitive_Guide-21-768x429.png)

![2025_TCR_Compliance_A_Definitive_Guide-3[1]](https://mytcrplus.com/wp-content/uploads/2026/02/2025_TCR_Compliance_A_Definitive_Guide-31-768x429.png)

![2025_TCR_Compliance_A_Definitive_Guide-4[1]](https://mytcrplus.com/wp-content/uploads/2026/02/2025_TCR_Compliance_A_Definitive_Guide-41-768x429.png)

![2025_TCR_Compliance_A_Definitive_Guide-5[1]](https://mytcrplus.com/wp-content/uploads/2026/02/2025_TCR_Compliance_A_Definitive_Guide-51-768x429.png)

![2025_TCR_Compliance_A_Definitive_Guide-6[1]](https://mytcrplus.com/wp-content/uploads/2026/02/2025_TCR_Compliance_A_Definitive_Guide-61-768x429.png)

![2025_TCR_Compliance_A_Definitive_Guide-7[1]](https://mytcrplus.com/wp-content/uploads/2026/02/2025_TCR_Compliance_A_Definitive_Guide-71-768x429.png)

![2025_TCR_Compliance_A_Definitive_Guide-8[1]](https://mytcrplus.com/wp-content/uploads/2026/02/2025_TCR_Compliance_A_Definitive_Guide-81-768x429.png)

![2025_TCR_Compliance_A_Definitive_Guide-9[1]](https://mytcrplus.com/wp-content/uploads/2026/02/2025_TCR_Compliance_A_Definitive_Guide-91-768x429.png)

![2025_TCR_Compliance_A_Definitive_Guide-10[1]](https://mytcrplus.com/wp-content/uploads/2026/02/2025_TCR_Compliance_A_Definitive_Guide-101-768x429.png)

![2025_TCR_Compliance_A_Definitive_Guide-11[1]](https://mytcrplus.com/wp-content/uploads/2026/02/2025_TCR_Compliance_A_Definitive_Guide-111-768x429.png)

![2025_TCR_Compliance_A_Definitive_Guide-12[1]](https://mytcrplus.com/wp-content/uploads/2026/02/2025_TCR_Compliance_A_Definitive_Guide-121-768x429.png)

![2025_TCR_Compliance_A_Definitive_Guide-13[1]](https://mytcrplus.com/wp-content/uploads/2026/02/2025_TCR_Compliance_A_Definitive_Guide-131-768x429.png)

![2025_TCR_Compliance_A_Definitive_Guide-14[1]](https://mytcrplus.com/wp-content/uploads/2026/02/2025_TCR_Compliance_A_Definitive_Guide-141-768x429.png)

![2025_TCR_Compliance_A_Definitive_Guide-15[1]](https://mytcrplus.com/wp-content/uploads/2026/02/2025_TCR_Compliance_A_Definitive_Guide-151-1-768x429.png)

The telecommunications industry stands at a critical inflection point as we progress through 2025. The Telecom Regulatory Commission’s (TCR) latest policy updates represent some of the most significant changes to communications compliance in recent years, reshaping how businesses approach text messaging strategy and customer engagement. For organizations relying on SMS to reach customers, understanding these revisions isn’t just about maintaining regulatory compliance—it’s about preserving the trust, accessibility, and operational effectiveness that modern commerce demands in an increasingly regulated digital environment.

The Foundation: Understanding Why These Changes Were Necessary

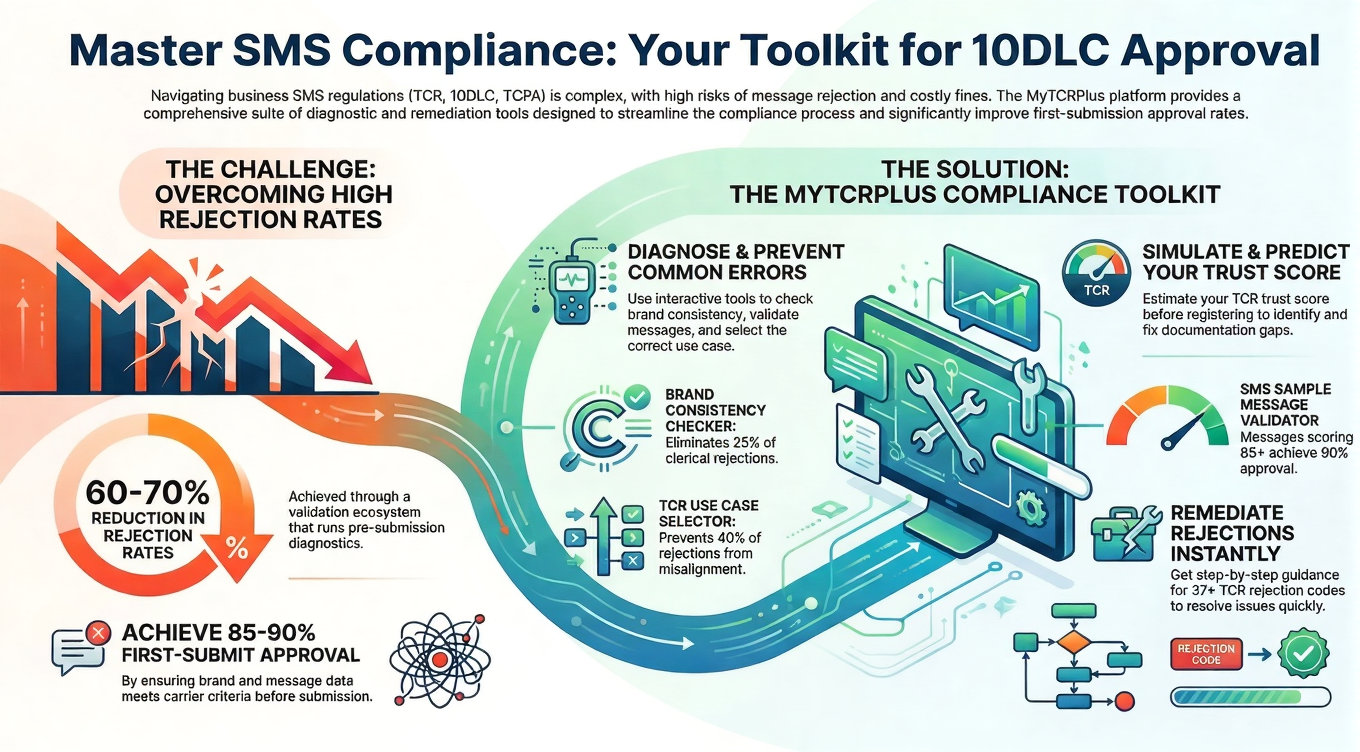

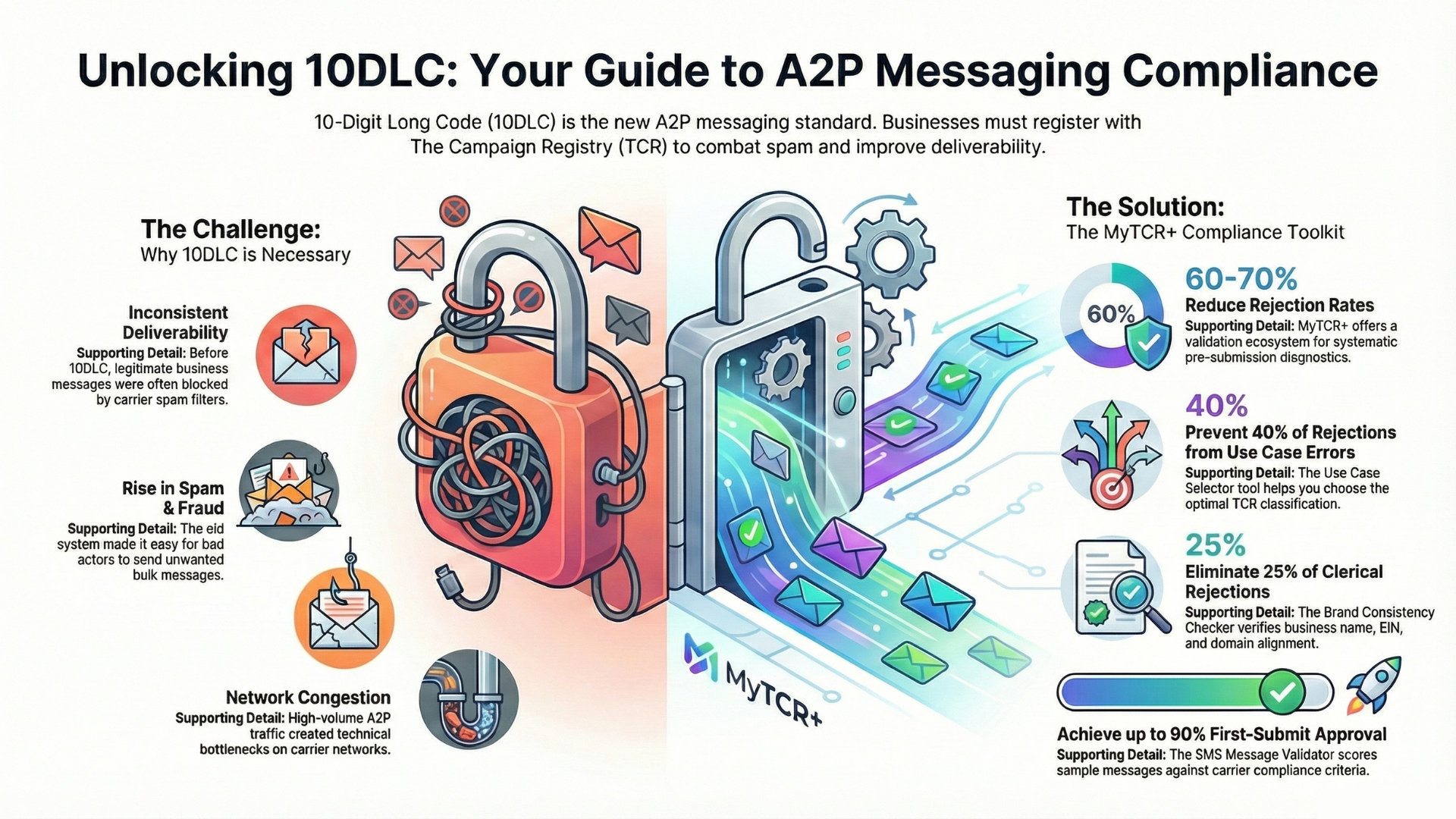

Before examining specific policy updates, it’s important to understand the context driving these regulatory shifts. The application-to-person (A2P) messaging landscape has evolved dramatically over the past five years. What was once a relatively niche communication channel has transformed into a critical business infrastructure supporting everything from appointment reminders and two-factor authentication to promotional campaigns and emergency notifications. This explosion in legitimate messaging volume has occurred simultaneously with rising abuse of SMS channels for spam, fraud, and phishing schemes.

Regulatory bodies and telecommunications carriers have faced increasing pressure to facilitate legitimate business communication while simultaneously protecting consumers from unwanted and fraudulent messaging. This balancing act has become more complex as bad actors have grown more sophisticated in their attempts to circumvent controls and exploit the trust consumers place in text messages. The 2025 TCR policy updates represent a comprehensive recalibration of this balance, prioritizing consumer protection while establishing clearer pathways for legitimate business communication.

Consumer complaints about SMS abuse have reached unprecedented levels, prompting intense scrutiny from the Federal Communications Commission, Federal Trade Commission, state attorneys general, and consumer advocacy organizations. At the same time, legitimate businesses have reported increasing delivery failures as carriers implement aggressive filtering to combat fraud. The 2025 updates attempt to address both concerns through a more sophisticated regulatory framework that can distinguish between legitimate commerce and abuse at scale.

The Fundamental Shift in Brand Verification and Vetting

At the heart of the 2025 updates lies a fundamental shift in how the TCR approaches brand vetting and message classification. TCR has moved from a relatively straightforward approval process to a more rigorous, multi-layered verification system that demands substantially more from businesses before granting approval to send A2P messages.

Under the new framework, companies must now provide enhanced documentation proving their legitimacy and operational integrity. This goes well beyond simple contact information and basic business details. The verification process now requires:

Business registration verification through official government records

Tax identification validation through IRS databases

Comprehensive information about the company’s ownership structure and key stakeholders

Detailed explanations of specific use cases for messaging

Documentation of consent mechanisms the company will implement to gather customer permission before sending messages

For larger corporations, this enhanced vetting process may represent a manageable increase in administrative burden. However, for smaller businesses, startups, and enterprises operating across multiple jurisdictions, the expanded documentation requirements create significant compliance complexity. Many smaller organizations may find themselves navigating an overwhelming array of requirements for the first time.

The rationale behind these enhanced requirements is straightforward: TCR aims to establish a more trustworthy ecosystem by ensuring that only legitimate organizations can register to send messages. By raising the bar for entry, TCR hopes to reduce the prevalence of fly-by-night operations that register briefly to conduct fraud campaigns, then abandon their registration. The enhanced vetting makes this registration-and-abandon strategy significantly more time-consuming and costly, theoretically deterring many bad actors.

The Dynamic Brand Reputation Scoring System: Compliance as an Ongoing Journey

One of the most impactful changes introduced in 2025 involves the revised brand reputation scoring system. Historically, TCR operated under a largely binary model where businesses either achieved registration approval or were rejected. Once approved, businesses could generally continue sending messages with minimal ongoing oversight, provided they didn’t trigger complaints severe enough to warrant investigation.

This approach has been fundamentally transformed. TCR has moved away from the binary approval process toward a dynamic scoring model that continuously evaluates sender behavior across multiple dimensions. This represents a seismic shift in compliance philosophy: maintaining approval is no longer a one-time achievement but an ongoing commitment that requires continuous attention and optimization.

Under the new system, multiple metrics feed into a brand’s reputation score. These include:

Message delivery rates that measure whether recipients and carriers are accepting messages or filtering them into spam folders.

Complaint ratios that track how many recipients report messages as unwanted or mark them as spam. The system aims to distinguish between complaints from genuine non-subscribers and those from recipients who simply don’t want promotional messages.

Engagement metrics that examine how many recipients open, read, or interact with messages.

Bounce rates that measure the percentage of messages that fail to reach recipients due to invalid numbers or other technical issues.

Unsubscribe patterns that monitor whether recipients are opting out at unusual rates, suggesting poor targeting or recipient dissatisfaction.

The practical implications are substantial. A business can no longer register once and ignore compliance requirements. Organizations must actively monitor their messaging performance, investigate declining metrics, and implement improvements when reputation scores trend downward. Carriers are increasingly implementing filtering based on these reputation scores, meaning that even a single registration can experience delivery degradation if reputation metrics decline.

This shift from static compliance to dynamic ongoing evaluation reflects an evolving regulatory philosophy about what legitimate compliance entails. Rather than simply checking boxes during registration, TCR is now demanding organizations demonstrate through their behavior that they are legitimate, responsible senders genuinely interested in customer preferences and engagement.

Enhanced Consent Management Requirements

The 2025 updates also address the evolving landscape of consent management with significant new requirements that reflect broader trends in data privacy and consumer protection. New guidelines require businesses to demonstrate more explicit opt-in mechanisms, moving beyond vague consent language to active, informed agreement for specific messaging purposes.

TCR’s updated consent requirements align closely with interpretations of consent by regulators enforcing GDPR in Europe and CASL in Canada. This standard mandates obtaining affirmative consent through clear language that explicitly describes the message types customers will receive. For instance, a customer checking a box labeled “I would like to receive offers and promotions” creates explicit consent, whereas someone who never actively agreed does not meet the standard—even if they have not complained.

Additionally, the new guidelines require businesses to maintain detailed records documenting how and when customers agreed to receive messages. These might include:

Screenshots of consent screens

Dates and times when customers opted in

The specific language presented to customers

The communication channel through which consent was obtained

Any communications confirming consent or explaining opt-out procedures

TCR can audit these records during investigations, and the burden of proof rests entirely on the business to demonstrate that proper consent was obtained. This change reflects a growing regulatory emphasis on consumer control over digital communications and recognizes that consent obtained through manipulation or unclear language isn’t genuine consent.

For businesses, this means investing in consent infrastructure that prioritizes clarity, documentation, and genuine customer choice, rather than optimizing for maximum registration rates at the expense of consent quality.

Financial Restructuring: The New Fee Model and Its Implications

Perhaps most significantly for smaller businesses and cost-conscious organizations, the fee structure has undergone substantial revision as part of the 2025 updates. The changes represent a conscious effort to create more equitable pricing that reflects actual usage patterns rather than the relatively flat registration costs that characterized the previous system.

Under the legacy system, businesses paid a registration fee that was largely independent of their messaging volume. For instance, a company sending 100,000 messages monthly paid essentially the same fee as a company sending one million messages. This structure created inequities where high-volume senders enjoyed economies of scale while occasional users subsidized their usage.

The new tiered system aims to create more proportional pricing by categorizing organizations based on their anticipated or actual message volume, brand count, and other usage metrics. High-volume senders operating multiple campaigns now find their fees more aligned with their actual system usage. This change could provide relief for enterprise organizations whose previous registration costs did not reflect their operational scale.

However, for occasional users and businesses sending limited volumes, the new pricing structure introduces complexities requiring careful financial analysis. Previously, a small business might register and pay a modest annual fee regardless of message volume. Under the new tiered system, the same business now needs to select an appropriate tier. If they underestimate their volume, they may face overage fees or tier upgrades mid-year.

This pricing restructure has compelled many organizations to conduct cost-benefit analyses of SMS messaging. For those using SMS as a supplementary communication channel rather than a primary tool, the updated fees may diminish return on investment enough to warrant reconsidering SMS strategy or consolidating messaging onto fewer campaigns. Others, especially high-volume senders, may find the new tiered structure favorable compared to the previous flat-rate model.

Businesses must carefully evaluate their expected message volumes, campaign complexities, brand requirements, and the true return on SMS investments. For those continuing with SMS, the new fee structure necessitates more deliberate planning around messaging frequency, segmentation, and campaign strategy than the previously unstructured approach.

Clarifying Ambiguities in Industry-Specific Messaging

The updated policies also clarify previously ambiguous areas around message content, particularly for industries where regulatory uncertainty has challenged compliance teams. The finance, healthcare, and cannabis sectors have faced difficulties understanding how TCR requirements intersect with industry-specific regulations on communications.

In financial services, the updated guidance provides more specific clarity about acceptable messaging practices for account alerts, fraud notifications, payment confirmations, and promotional offers. Financial institutions can now reference specific TCR guidance rather than relying on informed guesses regarding regulatory intent. This clarity allows compliance teams to operate more confidently, ensuring their messaging supports TCR requirements and regulations administered by the Consumer Financial Protection Bureau.

Healthcare messaging has similarly benefited from clarity. Medical providers, pharmacies, insurance companies, and health technology firms now have more detailed TCR guidance about appointment reminders, prescription alerts, treatment notifications, and patient education communications. This guidance clarifies what constitutes transactional messaging versus promotional messaging in healthcare contexts, helping organizations comply more effectively.

The cannabis industry, operating in a complex regulatory environment where messaging intersects with state-level legalization and advertising restrictions, has received welcome clarity in the updated policies. TCR now provides specific guidance on permissible cannabis-related messages, how to maintain compliance with state advertising restrictions while using SMS, and how to navigate the tension between federal prohibition and state legalization.

However, it’s crucial to note that TCR provides guidance, not solutions that eliminate regulatory complexity. Businesses must still navigate intersections with industry-specific regulations, and in some cases, those intersections may require legal counsel.

The Escalating Risks of Non-Compliance

For businesses not yet fully committed to TCR compliance, the 2025 updates underscore escalating risks associated with non-compliance. These risks have transitioned from theoretical or occasional issues to concrete and increasingly consequential realities.

Carriers are implementing aggressive filtering of messages from senders without proper TCR registration or with poor reputation scores. This means messages from non-compliant organizations, even if they contain legitimate content, may never reach intended recipients. They can disappear silently into spam folders, leaving businesses unaware of their communication failures. This creates a gap where businesses mistakenly believe they’re reaching customers, while those customers never receive the messages.

Beyond delivery failures, regulatory violations can trigger financial consequences that extend beyond TCR fines. Investigations by the FCC or FTC into non-compliant messaging can lead to significant civil penalties. Class-action lawsuits from consumers who received unwanted messages have resulted in settlements reaching millions of dollars. Business interruptions from messaging registration suspensions or account terminations can create immediate crises for organizations relying on SMS.

Moreover, non-compliance can also damage company reputation beyond the SMS channel. When news of violations or consumer lawsuits hits the market, it adversely affects brand perception and customer trust. SMS becomes a source of customer frustration and brand damage, rather than a tool for positive engagement.

What These Changes Signal About the Maturation of A2P Messaging

The 2025 TCR updates reflect a broader reality: the A2P messaging ecosystem is maturing from a relatively unregulated frontier to an increasingly structured, professionally managed infrastructure sector. This maturation brings both challenges and opportunities for organizations relying on SMS.

Text messaging has evolved from a supplementary communication tool to a primary customer engagement channel essential for competitive businesses. SMS is used regularly for appointment reminders, two-factor authentication, promotional offers, and customer service communications. This ubiquity has necessitated more sophisticated regulatory frameworks.

As SMS has become central to customer engagement strategies, the consequences of poor performance have increased. Businesses can no longer accept occasional message delivery failures as acceptable; customers expect reliability similar to that of phone calls or emails. This heightened expectation demands sophisticated infrastructure, better compliance practices, and more rigorous attention to performance management.

The regulatory framework must reflect this evolution. The relatively lightweight oversight that was appropriate for an emerging communication channel is no longer sufficient for critical business infrastructure. The 2025 updates establish standards that protect consumers from abuse while enabling legitimate businesses to use SMS effectively and reliably.

Strategic Recommendations for 2025 and Beyond

For organizations relying on SMS marketing, transactional messaging, or customer service texts, the message emerging from the 2025 TCR updates is clear: compliance is no longer optional, and understanding TCR’s evolving requirements is essential for maintaining effective customer communications.

Businesses should immediately audit their current TCR compliance status against the 2025 requirements. This includes:

Reviewing registration documentation

Ensuring current business information is accurate and complete

Evaluating consent mechanisms to meet updated standards

Documenting consent records meticulously

Organizations that haven’t maintained detailed consent documentation should begin doing so immediately.

Companies must also establish ongoing monitoring processes for brand reputation metrics. Compliance should no longer be treated as a one-time registration activity; organizations should implement systems that track delivery rates, complaint ratios, engagement metrics, and other factors influencing reputation scores. When metrics trend downward, organizations should investigate causes and implement improvements quickly.

For businesses evaluating their SMS investment decisions, the updated fee structure demands a thorough cost-benefit analysis. Organizations must calculate expected message volumes, evaluate appropriate tier placements, and assess whether SMS remains cost-effective for their communication goals. Those proceeding with SMS should ensure their messaging strategies are focused and targeted to generate positive return on investment.

Finally, organizations should stay informed about ongoing regulatory evolution. While the 2025 updates represent a significant reset, telecommunications regulation will continue evolving as carriers, regulators, and consumer advocates learn more about abuse patterns and legitimate business needs. Compliance is not a static target but rather an ongoing journey requiring continued learning and adaptation.

Conclusion: Embracing Compliance as Strategic Advantage

The 2025 TCR policy updates mark a pivotal transition point in how the telecommunications industry approaches A2P messaging governance. These changes create compliance obligations that demand organizational attention and investment. However, they also create opportunities for well-managed businesses to differentiate themselves through a genuine commitment to compliance and customer preferences.

Organizations that embrace these updated requirements, invest in robust compliance infrastructure, and prioritize customer preferences will find themselves with competitive advantages. Their messages will deliver reliably, while competitors struggle with filtering issues. Their brand reputation will strengthen through the demonstrated respect for customer communication preferences, leading to decreased regulatory risk.

The telecommunications landscape in 2025 and beyond will increasingly reward organizations that view compliance not as a burden but as a strategic imperative supporting effective customer communication. For businesses willing to make this shift in perspective, the 2025 TCR updates offer an opportunity to build customer relationships on foundations of trust, respect, and genuine customer preference—ultimately creating better outcomes for everyone involved in the digital communication ecosystem.