The landscape of business text messaging has undergone a dramatic transformation with the implementation of The Campaign Registry (TCR). For sole proprietors who want to leverage SMS marketing to connect with customers, understanding the Employer Identification Number (EIN) requirements has become essential for maintaining compliance and achieving successful campaign registration. This comprehensive guide explores everything sole proprietors need to know about navigating TCR’s EIN requirements and positioning their businesses for SMS marketing success.

Understanding The Campaign Registry and Its Purpose

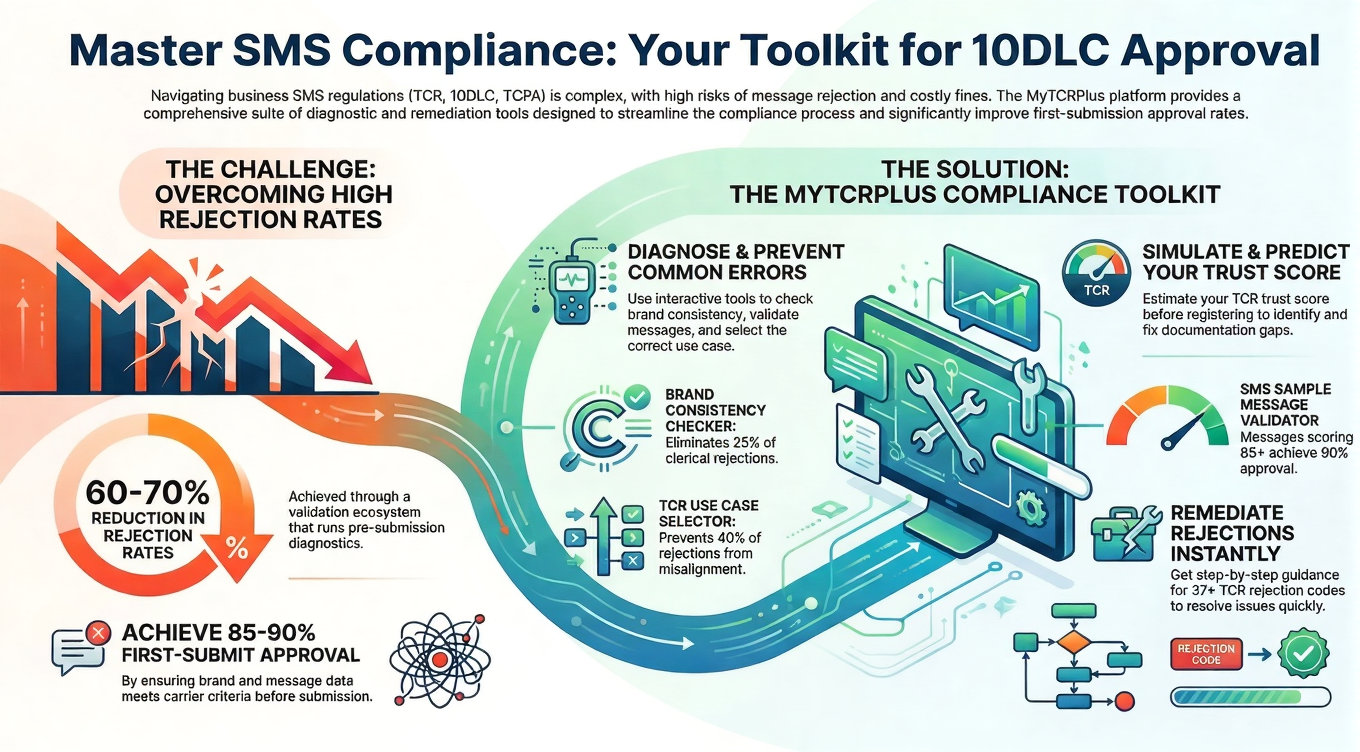

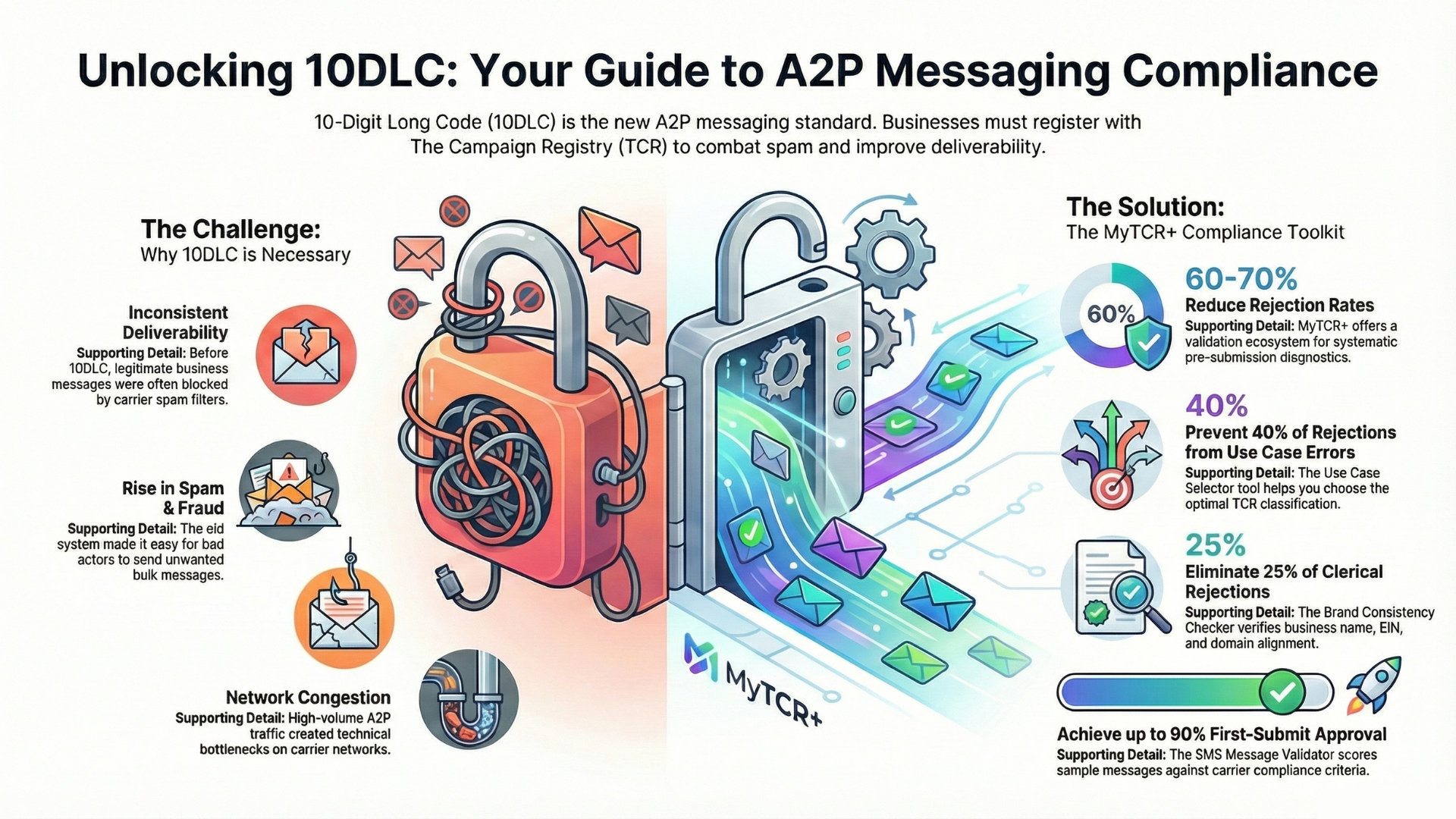

The Campaign Registry represents a fundamental shift in how businesses approach text message marketing throughout the United States. Launched as a centralized registration platform for Application-to-Person (A2P) messaging, TCR requires all businesses to verify their identity and legitimacy before sending commercial text messages to consumers. This isn’t arbitrary bureaucracy—the system was carefully designed to address the growing epidemic of spam and fraudulent messaging that has plagued mobile users for years.

By creating a verified ecosystem of legitimate businesses, TCR aims to protect consumers while ensuring that authentic companies can reach their customers effectively through SMS channels. Major wireless carriers including AT&T, T-Mobile, and Verizon have embraced this system, making registration mandatory for businesses that want to maintain reliable message delivery. The platform examines business credentials, assigns trust scores, and monitors messaging patterns to maintain the integrity of the A2P messaging ecosystem.

For established corporations with dedicated compliance teams, navigating TCR registration might be relatively straightforward. However, sole proprietors face unique challenges that stem from the informal nature of their business structure. Understanding these challenges and how EIN requirements factor into the registration process can mean the difference between smooth compliance and frustrating roadblocks.

The Sole Proprietor Dilemma: SSN versus EIN

One of the most common points of confusion for sole proprietors involves tax identification. Unlike corporations or LLCs that must obtain an Employer Identification Number from the IRS, sole proprietors have the option to operate using their Social Security Number (SSN). This flexibility has led millions of small business owners to skip the EIN application process entirely, conducting business under their personal SSN without any issues—until they encounter systems like TCR that expect formal business identification numbers.

The challenge arises because TCR’s registration system and its various partners expect to verify businesses through traditional corporate identifiers. While the platform and some Campaign Service Providers (CSPs) technically may accept registrations using a Social Security Number, this approach introduces complications that can delay registration, limit your trust score, or create obstacles with specific carriers. The requirements can vary significantly depending on which messaging platform you’re using, which carrier networks you’re trying to access, and how your business is structured.

This variability creates a frustrating gray area for sole proprietors. Some may successfully register using their SSN with certain providers, while others encounter immediate rejection or requests for additional documentation. Rather than navigating this uncertain landscape, forward-thinking sole proprietors are recognizing that obtaining an EIN before attempting TCR registration represents a strategic advantage that simplifies the entire process.

Why an EIN Makes Sense Beyond TCR Compliance

Obtaining an Employer Identification Number delivers benefits that extend far beyond merely satisfying TCR requirements. First and foremost, having an EIN creates a clear separation between your personal identity and your business operations. This distinction becomes increasingly valuable as your business grows and your SMS marketing campaigns scale. Using your Social Security Number for business purposes exposes your personal identification in numerous contexts—on applications, in databases, and across various platforms. An EIN contains this exposure and provides a dedicated business identifier that doesn’t compromise your personal privacy.

From a professional credibility standpoint, an EIN signals that you’re operating a legitimate business entity rather than a casual side venture. When TCR evaluators review your registration, seeing an EIN demonstrates commitment and professionalism. This can positively influence the trust score assigned to your business, which has direct implications for your messaging capabilities. Higher trust scores typically translate to increased daily messaging limits, access to more campaign types, and potentially lower fees—all factors that impact your bottom line and marketing effectiveness.

The process of obtaining an EIN from the IRS is remarkably straightforward and completely free. The online application typically takes fewer than fifteen minutes to complete, and in most cases, you’ll receive your EIN immediately upon submission. There are no fees, no complicated forms, and no waiting periods for sole proprietors applying online. This minimal investment of time yields a business asset that serves you not just for TCR registration, but for opening business bank accounts, applying for business credit, hiring employees in the future, and establishing vendor relationships.

The TCR Registration Process: What Sole Proprietors Should Expect

When you begin the TCR registration process, you’ll quickly discover that tax identification is just one piece of a comprehensive verification puzzle. The platform requires detailed business information that demonstrates your legitimacy and establishes your identity in the marketplace. Beyond your EIN or SSN, you’ll need to provide your legal business name, any “doing business as” (DBA) names you operate under, your business address, contact information, and details about your business structure.

TCR’s vetting process extends beyond collecting this basic information. The platform requires documentation that proves your business actually exists and operates legitimately. This might include business licenses issued by your state or local government, bank statements showing business account activity in your business name, utility bills or lease agreements for your business address, or website verification demonstrating your online presence. The specific documents required can vary based on your business type and the trust level TCR needs to establish.

This vetting process isn’t designed to be punitive—it’s a necessary component of creating a trusted messaging ecosystem. TCR evaluates the information you provide to assign a trust score to your business. This score reflects the platform’s confidence in your legitimacy and becomes a critical factor in determining your messaging capabilities. Businesses with higher trust scores enjoy greater flexibility, higher throughput, and fewer restrictions on their campaign types.

For sole proprietors, the trust score evaluation can be more challenging than it is for incorporated businesses. Corporations provide multiple verification touchpoints through their articles of incorporation, registered agent information, state business filings, and formal business structures. Sole proprietors lack these traditional markers of business legitimacy, which means every piece of documentation you can provide becomes more important. Having an EIN rather than using your SSN helps address this disparity by demonstrating that you’ve taken formal steps to establish your business identity with federal authorities.

How Trust Scores Impact Your SMS Marketing Capabilities

Understanding the implications of your TCR trust score is crucial for sole proprietors planning serious SMS marketing initiatives. Your trust score doesn’t simply determine whether you can send messages—it fundamentally shapes what you can accomplish with your campaigns. Lower trust scores typically result in significantly restricted daily message volumes, sometimes limited to just a few hundred messages per day. For businesses with modest customer bases, this might be sufficient, but for growing operations, these limitations can severely constrain marketing effectiveness.

Trust scores also influence the types of campaigns you’re permitted to run. Certain high-risk campaign categories, such as sweepstakes, debt-related messaging, or financial services communications, may be restricted for businesses with lower trust scores. If your sole proprietorship operates in any of these verticals, achieving a solid trust score during initial registration becomes even more critical. The difference between approval and rejection for these campaign types often hinges on the perceived legitimacy your registration conveys.

Financial implications flow directly from trust scores as well. Some carriers and Campaign Service Providers implement tiered pricing structures where businesses with lower trust scores pay premium rates for message delivery. These additional costs can accumulate quickly, especially for high-volume senders, making the initial investment in proper registration documentation—including obtaining an EIN—a cost-effective strategy in the long term.

Working with Campaign Service Providers

Most sole proprietors don’t register directly with TCR but rather work through Campaign Service Providers (CSPs) or messaging platforms that handle the registration process. These intermediaries connect businesses with carrier networks and manage the technical aspects of A2P messaging. When selecting a CSP, sole proprietors should inquire specifically about their EIN policies and what documentation they require for successful registration.

Some CSPs offer comprehensive white-glove registration services that guide sole proprietors through every step of the process. These services can be invaluable for business owners who find compliance requirements overwhelming or confusing. While there may be additional fees for this level of support, the time saved and frustration avoided often justify the investment, particularly for sole proprietors who need to focus on running their core business rather than navigating regulatory complexities.

Your relationship with your CSP extends beyond initial registration. As TCR requirements evolve and carriers adjust their policies, your provider should keep you informed of changes that affect your messaging capabilities. Establishing a relationship with a CSP that understands the unique challenges sole proprietors face can provide ongoing value as the A2P messaging landscape continues to develop.

Staying Ahead of Evolving Requirements

The regulatory environment surrounding business text messaging remains dynamic. TCR requirements continue to evolve as carriers refine their approaches to A2P messaging and as regulatory bodies respond to emerging patterns in spam and fraud. What works for registration today might face additional scrutiny or require supplemental documentation tomorrow. Sole proprietors must remain vigilant and adaptable as these changes unfold.

Monitoring industry news, staying connected with your CSP, and participating in relevant business communities can help you stay informed about regulatory shifts before they impact your operations. Many industry associations and messaging platforms provide regular updates about TCR changes, new carrier requirements, and best practices for maintaining compliance. Subscribing to these resources ensures you’re not caught off guard by sudden policy changes that could disrupt your messaging campaigns.

Best Practices for Sole Proprietors Approaching TCR Registration

Given the complexities and potential pitfalls of TCR registration, sole proprietors should approach the process strategically. The single most impactful step you can take is obtaining an EIN before beginning your registration. Even if your chosen CSP indicates they can work with your Social Security Number, having an EIN provides flexibility, improves your professional positioning, and potentially enhances your trust score evaluation.

Gather comprehensive documentation before starting your registration. Don’t wait until the platform requests specific documents—have your business license, bank statements, proof of address, and any relevant business certifications ready from the outset. This proactive approach accelerates the review process and demonstrates organizational competence that may positively influence evaluators.

Ensure absolute consistency across all documentation and registration information. Your business name should appear identically on your EIN confirmation, business license, bank statements, and TCR registration. Even minor discrepancies, such as using “LLC” in one place but not another or including or omitting punctuation inconsistently, can trigger verification delays or rejections. Review every document carefully before submission to ensure perfect alignment.

Be prepared for the possibility of additional verification requests. TCR’s vetting process sometimes requires follow-up documentation or clarification, particularly for sole proprietors whose business structures inherently provide fewer verification touchpoints. Respond promptly and thoroughly to any requests, providing exactly what’s asked for rather than overwhelming reviewers with unsolicited additional materials.

The Bottom Line for Sole Proprietors

For sole proprietors serious about leveraging text message marketing to grow their businesses, obtaining an EIN before beginning TCR registration represents more than just a compliance checkbox—it’s a strategic investment in your business infrastructure. While navigating the registration process with only a Social Security Number might be technically possible in some circumstances, the complications, potential limitations, and increased scrutiny you’ll face make this approach significantly more challenging than simply obtaining the EIN upfront.

The minimal time investment required to secure an EIN from the IRS—typically less than twenty minutes with immediate approval—delivers outsized returns in streamlined registration, professional credibility, and potentially improved trust scores. These benefits directly translate to more effective SMS marketing capabilities, which means better customer engagement, increased sales, and stronger business growth.

As the A2P messaging ecosystem continues maturing and requirements become more stringent, sole proprietors who establish proper business identification and maintain rigorous compliance position themselves for long-term success. Text message marketing represents one of the most effective direct communication channels available to small businesses, with open rates exceeding ninety percent and engagement levels that far surpass email or social media. Ensuring you can access this powerful channel without unnecessary complications or restrictions makes obtaining an EIN one of the smartest preparatory steps a sole proprietor can take.

The Campaign Registry isn’t designed to exclude small businesses or make compliance impossibly difficult—it exists to create a healthier messaging ecosystem that benefits legitimate businesses and protects consumers. By understanding EIN requirements, preparing thorough documentation, and approaching registration strategically, sole proprietors can navigate TCR successfully and unlock the full potential of SMS marketing for their business growth.