Hidden Costs of TCR Rejections: Why $40 Fees Are Just the Start

The Hidden Costs of TCR Registration Rejections: Why $40 Fees Are Just the Beginning

When your TCR registration gets rejected, the immediate $40-50 resubmission fee feels like a minor inconvenience. Operations teams write it off as a cost of doing business. Compliance officers categorize it under “regulatory overhead.” Finance barely notices the line item.

This perspective misses the broader financial impact by orders of magnitude. TCR rejections trigger cascading costs that compound across departments, timelines, and revenue streams. Organizations focused solely on the visible resubmission fee overlook opportunity costs, operational disruption, and strategic delays that dwarf the initial penalty.

The Visible Surface: Direct Registration Fees

The Campaign Registry charges $40 per rejected brand registration and $10 per rejected campaign registration. These fees accumulate quickly when submissions fail repeatedly. Organizations experiencing multiple rejection cycles can face hundreds of dollars in direct costs before achieving approval.

Consider a mid-market company registering five campaign use cases. Each rejection cycle costs $250 in direct fees. Three rejection cycles—common for organizations without compliance expertise—generate $750 in resubmission costs alone. The math scales linearly with campaign volume.

Large enterprises managing dozens of messaging programs face proportionally higher exposure. A Fortune 500 company with 25 active campaigns could incur $2,500 per rejection cycle. Multiple rejection rounds push direct costs into five-figure territory before a single message reaches consumers.

These visible costs represent the smallest component of total rejection impact. Direct fees constitute roughly 5-10% of aggregate financial damage from failed registrations.

Revenue Disruption: The Real Financial Impact

TCR rejections halt messaging program launches. Marketing campaigns remain in planning phases. Customer service automation waits for approval. Sales teams lose automated lead nurturing capabilities. Revenue-generating activities stall while compliance teams troubleshoot submissions.

Time-to-market delays from rejection cycles typically span 30-90 days. Each rejection requires documentation review, content revision, and resubmission processing. Carrier review cycles add additional weeks. Organizations with limited compliance expertise face longer delays as they iterate through trial-and-error approaches.

Revenue impact calculations reveal the true cost magnitude. A retail organization planning a holiday marketing campaign faces direct revenue loss when TCR delays push launch dates past peak shopping periods. A software company’s product announcement messaging may miss critical industry events due to compliance bottlenecks.

Quantifying these impacts requires examining specific scenarios across industry verticals.

E-commerce and Retail

E-commerce operations depend on messaging for cart abandonment recovery, shipping notifications, and promotional campaigns. TCR delays disrupt these revenue-critical workflows. A mid-market retailer generating $50 million annually through messaging-supported channels might lose $500,000-1,000,000 in quarterly revenue from delayed campaign launches.

Holiday seasons amplify these impacts. Black Friday campaigns delayed by TCR rejections cannot be recovered through makeup messaging. The seasonal window closes permanently. Revenue loss becomes absolute rather than deferred.

Healthcare and Professional Services

Healthcare organizations rely on messaging for appointment reminders, prescription notifications, and patient communication. TCR rejection delays create operational gaps that impact patient satisfaction and revenue cycle management. A multi-location medical practice might lose $100,000-300,000 quarterly from reduced appointment adherence and delayed patient communications.

Professional services firms use messaging for client updates, consultation scheduling, and service delivery coordination. Rejection delays fragment client communication strategies and reduce engagement rates. Legal practices, accounting firms, and consulting organizations face similar revenue disruption patterns.

Financial Services

Financial institutions leverage messaging for fraud alerts, payment reminders, and account notifications. TCR delays compromise customer service quality and regulatory compliance timelines. Banks and credit unions face dual challenges: revenue loss from reduced customer engagement plus potential regulatory exposure from communication gaps.

Investment firms rely on messaging for portfolio updates and compliance communications. TCR rejection delays create regulatory risks that extend beyond revenue considerations into legal and reputational territories.

Operational Costs: Resource Allocation and Productivity Loss

TCR rejections consume internal resources across multiple departments. Compliance teams dedicate time to rejection analysis and resubmission preparation. Marketing teams revise content and messaging strategies. Legal teams review documentation and policy alignment. IT teams coordinate with messaging vendors and platform providers.

Resource allocation calculations demonstrate the productivity impact. A typical rejection resolution cycle requires 20-40 hours of internal effort distributed across compliance, marketing, and technical teams. At blended internal rates of $100-150 per hour, each rejection cycle costs $2,000-6,000 in internal productivity.

Organizations lacking TCR expertise face higher resource consumption. Teams without regulatory knowledge spend additional time researching requirements, consulting external resources, and iterating through approval processes. Internal costs can reach $10,000-15,000 per rejection cycle for complex campaigns.

Opportunity Cost Analysis

Internal resources dedicated to TCR remediation cannot focus on other strategic initiatives. Marketing teams delay campaign development. Compliance teams postpone other regulatory projects. Technical teams defer platform improvements and integration work.

Opportunity costs compound when rejection cycles extend program timelines. Strategic initiatives get backlogged. Revenue-generating projects face resource constraints. Innovation efforts receive reduced attention and funding.

Vendor Management Overhead

TCR rejections increase vendor management complexity. Organizations must coordinate with messaging providers, compliance consultants, and platform vendors to resolve rejection issues. Multiple vendor relationships require additional oversight and communication.

Vendor management costs include coordination meetings, documentation sharing, and strategic alignment discussions. These activities consume senior-level resources and create scheduling complexity across external relationships.

Strategic Delays: Market Positioning and Competitive Impact

TCR rejection delays affect market timing and competitive positioning. Organizations unable to launch messaging programs cede communication advantages to competitors. Customer engagement strategies fall behind industry standards. Brand communication consistency suffers from platform gaps.

First-mover advantages in messaging channels disappear when TCR delays extend launch timelines. Competitors with approved registrations capture audience attention and establish communication preferences. Market share erosion begins before delayed programs achieve approval.

Customer Experience Degradation

TCR delays fragment customer communication experiences. Organizations cannot deliver consistent messaging across channels. Customer expectations for timely notifications and responsive communication remain unmet. Satisfaction scores decline as communication gaps impact service delivery.

Customer acquisition costs increase when messaging automation remains unavailable. Manual communication processes require higher resource allocation per customer interaction. Scalability constraints limit growth potential and operational efficiency.

Brand Reputation Risks

Extended TCR delays signal operational immaturity to industry observers. Messaging partners and platform providers recognize organizations with chronic compliance challenges. Vendor relationships suffer when repeated delays impact mutual initiatives and strategic planning.

Industry reputation effects extend beyond immediate messaging concerns. Compliance challenges in one regulatory area raise questions about broader operational capabilities. Partnership opportunities diminish when organizations demonstrate consistent approval difficulties.

Compliance Cascade: Regulatory and Audit Implications

TCR rejections indicate compliance program weaknesses that extend beyond messaging regulations. Organizations struggling with TCR requirements often face challenges in other regulatory areas. TCPA compliance, privacy regulations, and industry-specific requirements may receive inadequate attention.

Audit implications multiply when compliance programs demonstrate systematic weaknesses. Internal audit teams scrutinize messaging practices more closely. External auditors expand review scope to examine broader compliance capabilities. Regulatory agencies increase attention to organizations with repeated approval failures.

Documentation and Evidence Gaps

TCR rejections often stem from inadequate documentation and evidence preparation. These gaps indicate broader compliance documentation weaknesses. Organizations may lack systematic approaches to consent management, policy documentation, and audit trail maintenance.

Documentation gaps create risks across multiple regulatory domains. GDPR compliance, CCPA requirements, and industry-specific privacy regulations depend on similar documentation standards. Weaknesses in one area suggest vulnerabilities in others.

Vendor and Partner Compliance

Messaging vendors and platform providers evaluate client compliance capabilities when establishing partnerships. Organizations with chronic TCR challenges face restricted access to premium services and strategic partnerships. Vendor relationships suffer when repeated delays impact mutual commitments.

Partner compliance requirements may exclude organizations with demonstrated regulatory challenges. Strategic alliances and integration opportunities diminish when compliance track records indicate operational risks.

Risk Amplification: Legal and Regulatory Exposure

Failed TCR registrations create legal and regulatory exposure beyond immediate messaging concerns. Organizations operating without proper registrations face TCPA violation risks. Unauthorized messaging can trigger consumer complaints and regulatory enforcement actions.

Legal costs from compliance violations dwarf TCR rejection fees. TCPA violations carry penalties of $500-1,500 per unauthorized message. Class action litigation exposure can reach millions of dollars for organizations with systematic violations.

Enforcement Action Risks

Regulatory agencies prioritize organizations with demonstrated compliance failures. TCR rejection patterns indicate higher enforcement risks. Agencies allocate investigation resources based on compliance track records and violation indicators.

Enforcement actions create costs beyond financial penalties. Legal fees, internal investigation costs, and remediation expenses compound primary penalties. Organizational resources shift from strategic initiatives to defensive activities.

Insurance and Risk Management

Compliance violations affect insurance coverage and risk management strategies. Cyber liability and errors and omissions insurance may exclude coverage for systematic regulatory violations. Premium increases reflect elevated risk profiles from compliance failures.

Risk management processes require additional oversight and controls when compliance challenges persist. Board-level attention increases as regulatory risks escalate. Strategic initiatives face additional scrutiny and approval requirements.

The Compounding Effect: How Delays Create Exponential Costs

TCR rejection impacts compound over time rather than remaining static. Initial delays create resource pressures that affect subsequent initiatives. Revenue losses reduce available capital for strategic investments. Operational inefficiencies multiply as teams allocate resources to remediation activities.

Compounding effects emerge across multiple dimensions simultaneously. Revenue delays reduce cash flow available for expansion initiatives. Resource allocation to compliance activities constrains innovation investments. Vendor relationship challenges limit strategic partnership opportunities.

Quarterly and Annual Impact Assessment

Organizations must evaluate TCR rejection costs across extended timeframes to understand full impact. Quarterly revenue disruptions affect annual performance metrics. Annual strategic plans require revision when messaging initiatives face extended delays.

Financial modeling must incorporate these extended impacts to accurately assess TCR rejection costs. Simple fee calculations underestimate total impact by 90-95%. Comprehensive cost models reveal the true financial significance of approval failures.

Industry-Specific Impact Variations

Different industries face varying levels of TCR rejection impact based on messaging dependency and regulatory complexity. Healthcare organizations face higher compliance risks due to HIPAA requirements. Financial services encounter additional regulatory oversight from banking agencies.

E-commerce and retail operations experience more immediate revenue impacts due to seasonal messaging dependencies. B2B services face longer sales cycle disruptions when messaging automation remains unavailable. Professional services encounter client relationship challenges from communication gaps.

Regulatory Complexity Factors

Industries with complex regulatory environments face higher TCR rejection risks. Healthcare organizations must navigate HIPAA compliance alongside messaging regulations. Financial services must coordinate with banking compliance requirements. Insurance companies encounter state-specific regulatory variations.

Regulatory complexity increases both rejection probability and remediation costs. Organizations operating across multiple jurisdictions face compounded compliance challenges. Cross-border operations require additional expertise and coordination.

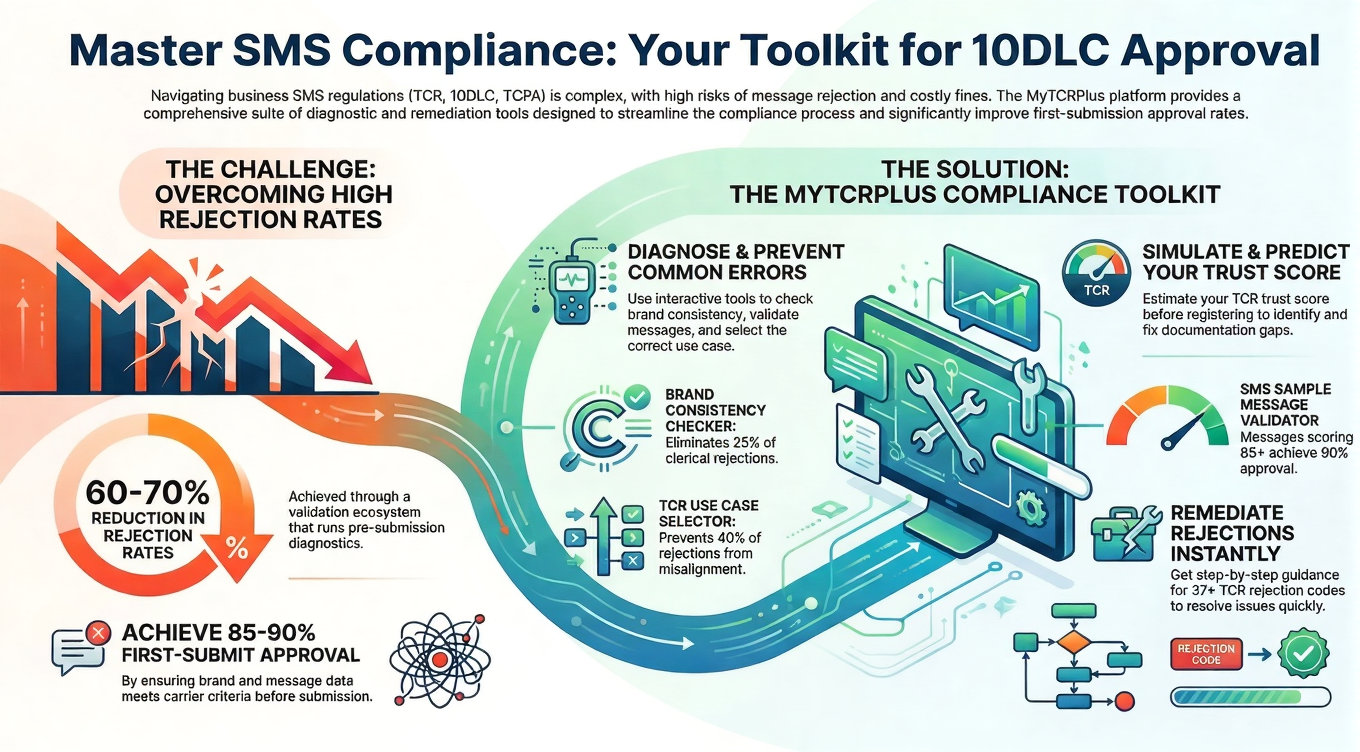

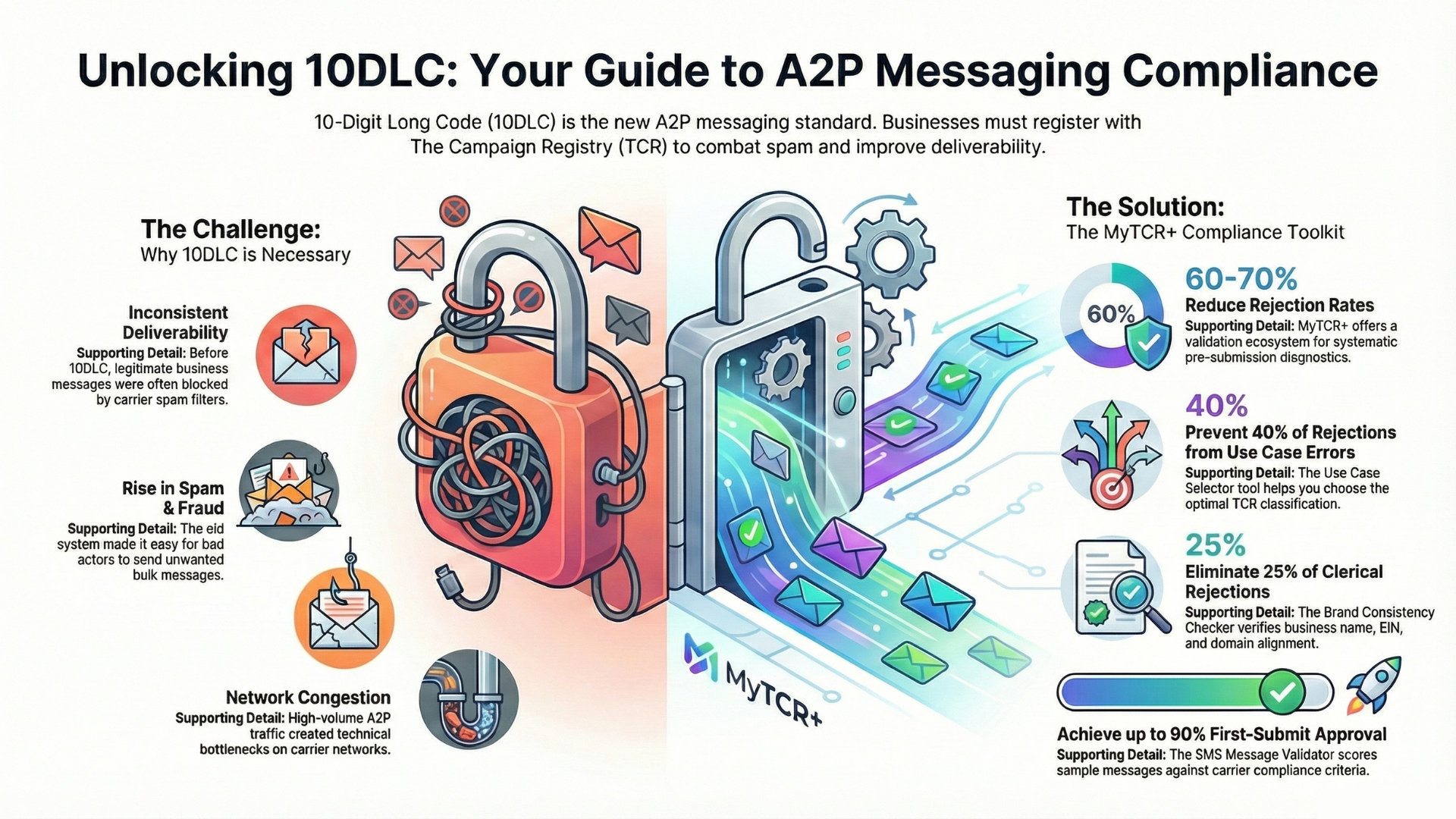

Mitigation Strategies: Reducing Rejection Risk and Impact

Organizations can implement systematic approaches to reduce TCR rejection risks and minimize impact from approval delays. Proactive compliance strategies address common rejection causes before submission. Contingency planning reduces operational impact when delays occur.

Comprehensive registration preparation includes documentation review, content optimization, and stakeholder alignment. Organizations should establish dedicated compliance resources and vendor relationships before initiating registration processes.

Systematic Compliance Approaches

Systematic compliance approaches standardize registration preparation and reduce rejection risks. Organizations should develop repeatable processes for documentation, content review, and submission coordination. Template libraries and checklists ensure consistent quality across multiple campaigns.

Regular compliance training keeps internal teams updated on regulatory requirements and best practices. Vendor management processes ensure external partners understand organizational standards and expectations.

Cost-Benefit Analysis Framework

Organizations should implement comprehensive cost-benefit analysis frameworks that account for full TCR rejection impact. Financial models should incorporate revenue delays, resource allocation costs, and strategic opportunity impacts.

Regular assessment of compliance costs versus outsourcing alternatives helps optimize resource allocation. Organizations may find external compliance expertise more cost-effective than internal capability development for complex regulatory environments.

Conclusion: The True Cost of Compliance Failures

TCR registration rejections cost organizations significantly more than resubmission fees suggest. Revenue delays, operational disruption, and strategic impacts create financial consequences that exceed direct costs by orders of magnitude. Organizations focusing solely on visible fees miss the broader economic impact of compliance failures.

Comprehensive cost assessment reveals why proactive compliance investment delivers strong returns. The difference between systematic compliance approaches and reactive remediation extends beyond immediate costs to strategic competitive advantages and operational excellence.

Smart organizations recognize TCR compliance as a strategic capability rather than a regulatory burden. Investing in systematic compliance approaches and expert resources produces better outcomes than managing rejection cycles reactively. The hidden costs of rejection make prevention the only viable long-term strategy.

RELATED POSTS

You may also like

SMS Compliance: Where to Start Your…

In today’s digital-first business environment, messaging platforms have become essential tools for…

10DLC Basics: Application-to-Person Messaging Explained

In today’s digital landscape, businesses rely heavily on text messaging to connect…

10DLC Basics: A2P Messaging Explained for…

If you’re planning to send marketing text messages to customers in the…

Streamlined Compliance, Zero Rejections

- Carrier-Friendly Structure—Designed for TCR/10DLC approvals

- Required Disclosures Included—Privacy, Terms, opt-in/opt-out language

- Sample Messages—Clear examples for provider review

- Hands-Off Hosting—Updates, SSL, and support included