TCR Registration vs. Internal Documentation: Build vs. Buy Decision Framework

TCR Registration vs. Internal Documentation: Build vs. Buy Decision Framework

Enterprise messaging programs face a critical inflection point when selecting compliance infrastructure. The choice between developing internal TCR registration capabilities and partnering with specialized compliance providers determines operational efficiency, regulatory risk exposure, and resource allocation for years ahead.

The Compliance Infrastructure Decision

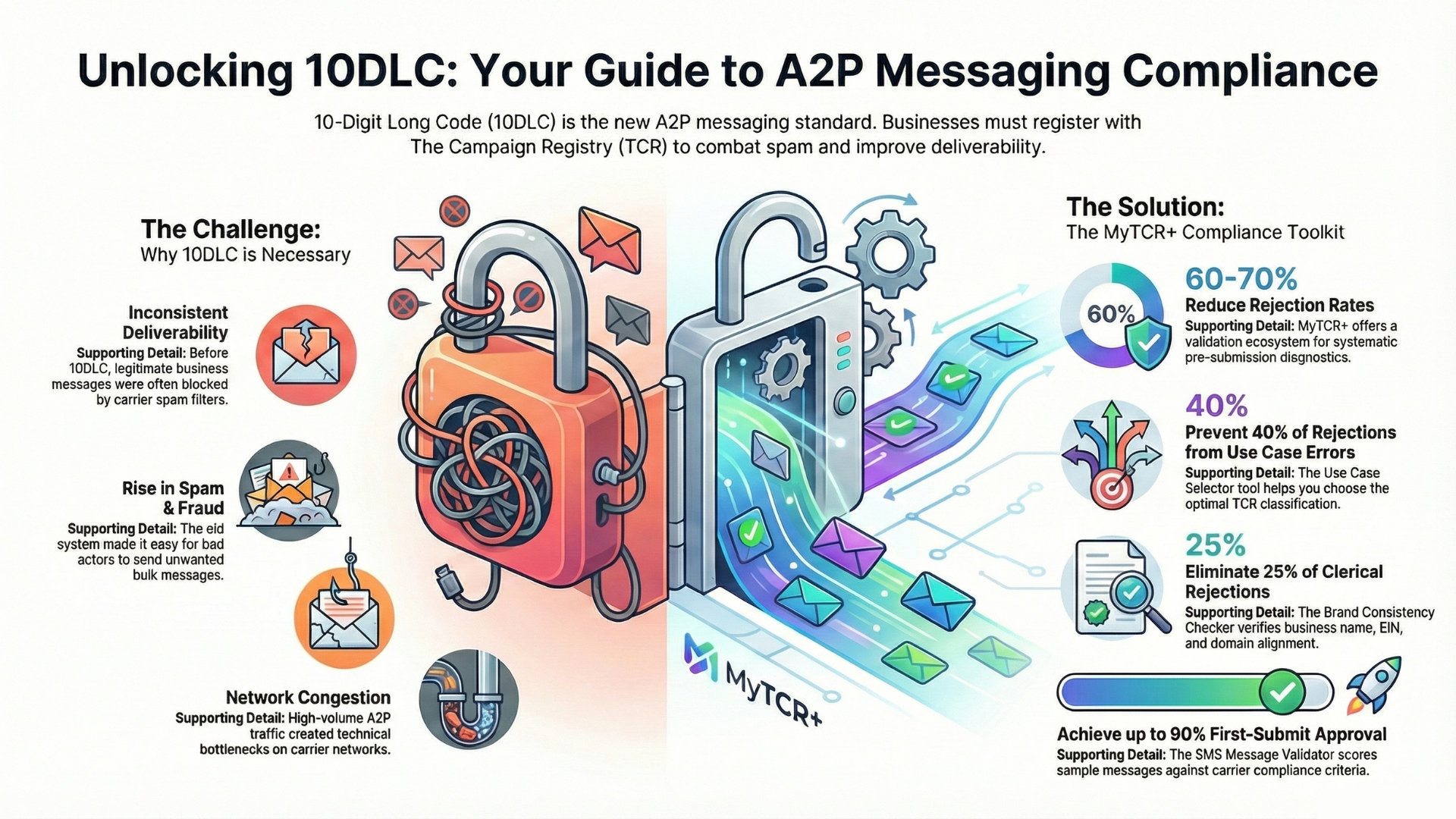

Organizations deploying business messaging confront complex regulatory requirements spanning TCPA consent management, 10DLC carrier approval processes, and TCR campaign documentation. The fundamental question centers on resource deployment: internal development versus external partnership.

Internal development promises control and customization. External partnerships deliver specialized expertise and operational scale. Neither approach eliminates compliance obligations, but each creates distinct risk-reward profiles that executives must evaluate against organizational capabilities and strategic priorities.

Internal Development: Resource Requirements and Hidden Costs

Building compliance infrastructure internally requires sustained investment across multiple operational domains. Legal expertise becomes essential for interpreting evolving TCPA regulations and carrier policy shifts. Technical resources must architect consent capture mechanisms, audit trail systems, and carrier integration protocols.

The personnel requirements extend beyond initial development. Ongoing maintenance demands dedicated resources to monitor regulatory changes, update documentation templates, and maintain carrier relationship protocols. Organizations typically underestimate these operational overhead costs when evaluating internal development options.

Documentation maintenance represents a particularly resource-intensive requirement. TCR registration demands current policy language, compliant consent mechanisms, and carrier-approved message templates. Internal teams must track regulatory updates across multiple jurisdictions while maintaining version control and audit capabilities.

Carrier relationship management adds another layer of complexity. Each major carrier maintains distinct approval criteria and documentation requirements. Internal teams must develop expertise across AT&T, Verizon, T-Mobile, and other carrier-specific processes while maintaining current knowledge of policy evolution.

External Partnership: Specialization Benefits and Control Trade-offs

Compliance specialists offer concentrated expertise developed across multiple client implementations. These providers maintain current knowledge of carrier requirements, regulatory interpretations, and approval best practices through dedicated focus on messaging compliance.

Specialized providers deliver operational advantages through economies of scale. Template libraries, approval workflows, and carrier relationship protocols represent shared infrastructure that reduces individual client costs while accelerating implementation timelines.

The trade-off involves reduced direct control over compliance processes. Organizations depend on external providers for regulatory interpretation, carrier communication, and documentation updates. This dependency requires careful vendor evaluation and contractual protection mechanisms.

Risk distribution represents another consideration. Specialized providers aggregate compliance risk across multiple clients, potentially offering superior protection through concentrated expertise. However, organizations must evaluate provider stability, expertise depth, and contractual liability provisions.

Technical Infrastructure: Development Complexity Analysis

TCR compliance requires robust technical infrastructure supporting consent capture, audit trails, and carrier integration protocols. Internal development teams must architect systems handling multiple consent mechanisms while maintaining TCPA-compliant documentation standards.

Database architecture becomes critical for maintaining audit trails and version control. Organizations need systems tracking consent timestamps, message approval workflows, and carrier submission histories. These requirements demand specialized database design and maintenance capabilities.

Integration complexity multiplies across carrier platforms and internal messaging systems. Each carrier maintains distinct API requirements and documentation standards. Internal teams must develop and maintain multiple integration protocols while ensuring system reliability and security compliance.

Security requirements add operational overhead through encryption protocols, access controls, and backup procedures. Compliance systems handle sensitive consumer data requiring enterprise-grade security implementations and ongoing vulnerability management.

Regulatory Risk Assessment: Internal vs. External Expertise

Compliance risk evaluation requires specialized knowledge of TCPA interpretation, carrier policy evolution, and enforcement precedent analysis. Internal legal teams must develop expertise across multiple regulatory domains while maintaining current knowledge of interpretation shifts.

Regulatory monitoring demands continuous investment in legal research, carrier communication tracking, and policy interpretation updates. Organizations must dedicate resources to tracking Federal Communications Commission guidance, carrier policy announcements, and enforcement action analysis.

Error consequences vary significantly between internal and external approaches. Internal compliance failures result in direct organizational liability exposure. External provider errors may offer contractual protection mechanisms depending on service agreement terms and provider liability coverage.

Documentation accuracy requirements create ongoing legal risk exposure. Incorrect consent language, outdated policy references, or non-compliant message templates can result in significant financial penalties under TCPA enforcement actions.

Cost Structure Analysis: Total Ownership Comparison

Internal development costs extend beyond initial system architecture through ongoing maintenance, personnel, and infrastructure requirements. Organizations must budget for legal consultation, technical maintenance, regulatory monitoring, and carrier relationship management.

Personnel costs represent the largest component of internal development approaches. Legal expertise commands premium compensation while technical resources require specialized knowledge of messaging protocols and compliance systems. These resources must remain dedicated to compliance maintenance rather than revenue-generating activities.

Infrastructure costs include system development, security implementation, backup procedures, and disaster recovery capabilities. These technical requirements demand enterprise-grade implementations with associated licensing, maintenance, and upgrade costs.

External provider costs offer more predictable budget planning through subscription models and defined service levels. Organizations can evaluate total cost structures against internal resource requirements while accessing specialized expertise and operational scale benefits.

Operational Efficiency: Speed and Accuracy Trade-offs

Internal development timelines typically extend beyond external provider implementations due to learning curve requirements and resource allocation constraints. Organizations must develop expertise while building infrastructure, creating extended implementation periods.

Accuracy advantages vary based on organizational expertise and provider selection. Specialized providers offer concentrated experience across multiple implementations while internal teams develop organization-specific knowledge. Both approaches can achieve compliance objectives through different expertise development paths.

Maintenance efficiency heavily favors external providers through dedicated resource allocation and specialized focus. Internal teams must balance compliance maintenance against other organizational priorities while providers maintain dedicated compliance focus.

Scaling capabilities differ significantly between approaches. Internal systems require proportional resource increases for expanded messaging volumes while provider partnerships often offer flexible scaling through service tier adjustments.

Strategic Control: Decision Authority and Flexibility

Internal development provides complete control over compliance interpretation, documentation standards, and carrier relationship management. Organizations maintain direct decision authority over risk tolerance levels and compliance approach modifications.

Provider partnerships require shared decision-making around compliance interpretation and documentation standards. Organizations must evaluate provider alignment with risk tolerance preferences and strategic messaging objectives.

Flexibility requirements vary based on organizational messaging strategy evolution. Internal systems can adapt quickly to strategic shifts while provider partnerships may require contract modifications or service tier adjustments.

Exit strategy considerations differ between approaches. Internal systems create organizational knowledge assets with switching costs limited to new provider onboarding. Provider dependencies create switching costs through knowledge transfer requirements and system integration changes.

Compliance Assurance: Audit and Documentation Standards

Audit readiness requires comprehensive documentation systems tracking consent collection, message approval workflows, and carrier submission histories. Internal systems must architect these capabilities while external providers offer pre-built audit trail systems.

Documentation accuracy becomes critical for regulatory compliance and enforcement defense. Specialized providers maintain template libraries updated for regulatory changes while internal teams must develop and maintain documentation standards independently.

Version control requirements demand systematic tracking of policy updates, consent language modifications, and carrier requirement changes. These capabilities require dedicated system architecture and maintenance procedures.

Evidence preservation standards require long-term data retention with secure access controls and backup procedures. Organizations must evaluate internal storage capabilities against provider data management services.

Technology Stack: Platform Integration Considerations

System integration requirements vary significantly based on existing messaging platform architecture and carrier relationship protocols. Internal development must accommodate current technology investments while provider solutions may require platform modifications.

API compatibility becomes essential for seamless operation across messaging platforms and carrier integration requirements. Organizations must evaluate technical compatibility requirements against development resource availability.

Scalability architecture determines long-term system viability as messaging volumes and compliance requirements evolve. Internal systems require forward-looking architectural decisions while provider platforms offer scaling flexibility through service agreements.

Security implementation requirements demand enterprise-grade protocols regardless of internal or external approaches. Organizations must evaluate security capabilities and compliance standards across both development paths.

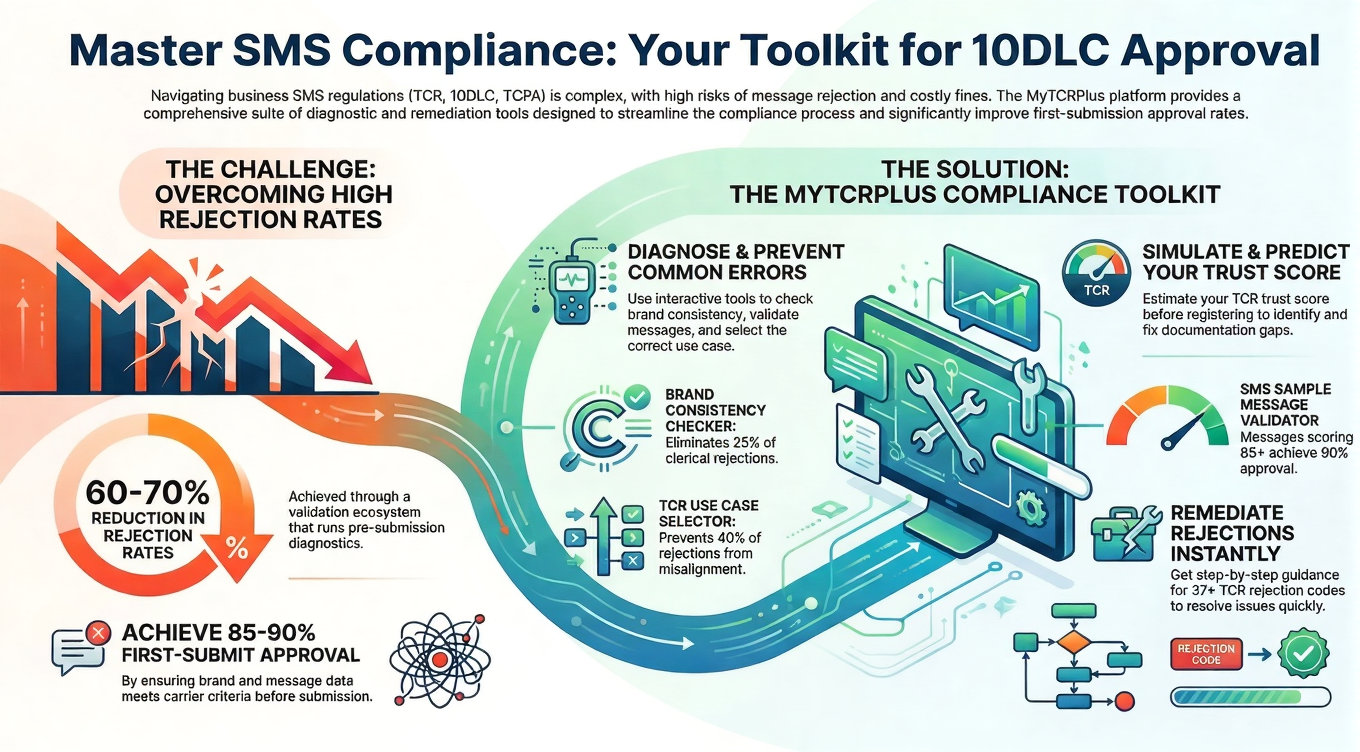

The myTCRPlus Advantage: Specialized Compliance Infrastructure

myTCRPlus delivers purpose-built compliance microsites addressing TCR registration requirements through carrier-approved templates and automated documentation systems. The platform eliminates internal development complexity while providing audit-ready compliance infrastructure.

Specialized expertise across TCPA interpretation, carrier approval processes, and documentation standards reduces organizational risk exposure through concentrated compliance focus. Template libraries remain current with regulatory changes while automated systems maintain version control and audit capabilities.

Operational efficiency advantages include accelerated implementation timelines, predictable cost structures, and flexible scaling options. Organizations access enterprise-grade compliance capabilities without internal resource dedication or infrastructure investment.

Strategic flexibility remains through customizable documentation standards, brand-aligned microsites, and adaptable service tiers. Organizations maintain compliance control while accessing specialized expertise and operational scale benefits.

Decision Framework: Evaluation Criteria

Resource availability assessment requires honest evaluation of internal legal expertise, technical capabilities, and ongoing maintenance capacity. Organizations must consider opportunity costs of dedicated compliance focus versus revenue-generating activities.

Risk tolerance evaluation determines acceptable compliance exposure levels and preferred control mechanisms. High-risk tolerance organizations may favor internal development while risk-averse enterprises benefit from specialized provider partnerships.

Strategic importance assessment evaluates messaging program significance to overall business objectives. Core business messaging programs may justify internal investment while supporting functions benefit from external partnerships.

Cost optimization analysis compares total ownership costs across development approaches while considering resource allocation flexibility and scalability requirements.

Compliance infrastructure decisions shape operational efficiency and risk exposure for enterprise messaging programs. Internal development offers control advantages through dedicated resource allocation while specialized providers deliver expertise and operational scale benefits. Organizations must evaluate these trade-offs against resource availability, risk tolerance, and strategic messaging objectives to determine optimal compliance infrastructure approaches.

RELATED POSTS

You may also like

SMS Compliance: Where to Start Your…

In today’s digital-first business environment, messaging platforms have become essential tools for…

10DLC Basics: Application-to-Person Messaging Explained

In today’s digital landscape, businesses rely heavily on text messaging to connect…

10DLC Basics: A2P Messaging Explained for…

If you’re planning to send marketing text messages to customers in the…

Streamlined Compliance, Zero Rejections

- Carrier-Friendly Structure—Designed for TCR/10DLC approvals

- Required Disclosures Included—Privacy, Terms, opt-in/opt-out language

- Sample Messages—Clear examples for provider review

- Hands-Off Hosting—Updates, SSL, and support included