![Building_an_Effective_SMS_Compliance_Team_Key_Roles_&_Responsibilities_slide_deck_-_no_wm-1[1]](https://mytcrplus.com/wp-content/uploads/2026/01/Building_an_Effective_SMS_Compliance_Team_Key_Roles__Responsibilities_slide_deck_-_no_wm-11-768x429.png)

![Building_an_Effective_SMS_Compliance_Team_Key_Roles_&_Responsibilities_slide_deck_-_no_wm-2[1]](https://mytcrplus.com/wp-content/uploads/2026/01/Building_an_Effective_SMS_Compliance_Team_Key_Roles__Responsibilities_slide_deck_-_no_wm-21-768x429.png)

![Building_an_Effective_SMS_Compliance_Team_Key_Roles_&_Responsibilities_slide_deck_-_no_wm-3[1]](https://mytcrplus.com/wp-content/uploads/2026/01/Building_an_Effective_SMS_Compliance_Team_Key_Roles__Responsibilities_slide_deck_-_no_wm-31-768x429.png)

![Building_an_Effective_SMS_Compliance_Team_Key_Roles_&_Responsibilities_slide_deck_-_no_wm-4[1]](https://mytcrplus.com/wp-content/uploads/2026/01/Building_an_Effective_SMS_Compliance_Team_Key_Roles__Responsibilities_slide_deck_-_no_wm-41-768x429.png)

![Building_an_Effective_SMS_Compliance_Team_Key_Roles_&_Responsibilities_slide_deck_-_no_wm-5[1]](https://mytcrplus.com/wp-content/uploads/2026/01/Building_an_Effective_SMS_Compliance_Team_Key_Roles__Responsibilities_slide_deck_-_no_wm-51-768x429.png)

![Building_an_Effective_SMS_Compliance_Team_Key_Roles_&_Responsibilities_slide_deck_-_no_wm-6[1]](https://mytcrplus.com/wp-content/uploads/2026/01/Building_an_Effective_SMS_Compliance_Team_Key_Roles__Responsibilities_slide_deck_-_no_wm-61-768x429.png)

![Building_an_Effective_SMS_Compliance_Team_Key_Roles_&_Responsibilities_slide_deck_-_no_wm-7[1]](https://mytcrplus.com/wp-content/uploads/2026/01/Building_an_Effective_SMS_Compliance_Team_Key_Roles__Responsibilities_slide_deck_-_no_wm-71-768x429.png)

![Building_an_Effective_SMS_Compliance_Team_Key_Roles_&_Responsibilities_slide_deck_-_no_wm-8[1]](https://mytcrplus.com/wp-content/uploads/2026/01/Building_an_Effective_SMS_Compliance_Team_Key_Roles__Responsibilities_slide_deck_-_no_wm-81-768x429.png)

![Building_an_Effective_SMS_Compliance_Team_Key_Roles_&_Responsibilities_slide_deck_-_no_wm-9[1]](https://mytcrplus.com/wp-content/uploads/2026/01/Building_an_Effective_SMS_Compliance_Team_Key_Roles__Responsibilities_slide_deck_-_no_wm-91-768x429.png)

![Building_an_Effective_SMS_Compliance_Team_Key_Roles_&_Responsibilities_slide_deck_-_no_wm-10[1]](https://mytcrplus.com/wp-content/uploads/2026/01/Building_an_Effective_SMS_Compliance_Team_Key_Roles__Responsibilities_slide_deck_-_no_wm-101-768x429.png)

![Building_an_Effective_SMS_Compliance_Team_Key_Roles_&_Responsibilities_slide_deck_-_no_wm-11[1]](https://mytcrplus.com/wp-content/uploads/2026/01/Building_an_Effective_SMS_Compliance_Team_Key_Roles__Responsibilities_slide_deck_-_no_wm-111-768x429.png)

![Building_an_Effective_SMS_Compliance_Team_Key_Roles_&_Responsibilities_slide_deck_-_no_wm-12[1]](https://mytcrplus.com/wp-content/uploads/2026/01/Building_an_Effective_SMS_Compliance_Team_Key_Roles__Responsibilities_slide_deck_-_no_wm-121-768x429.png)

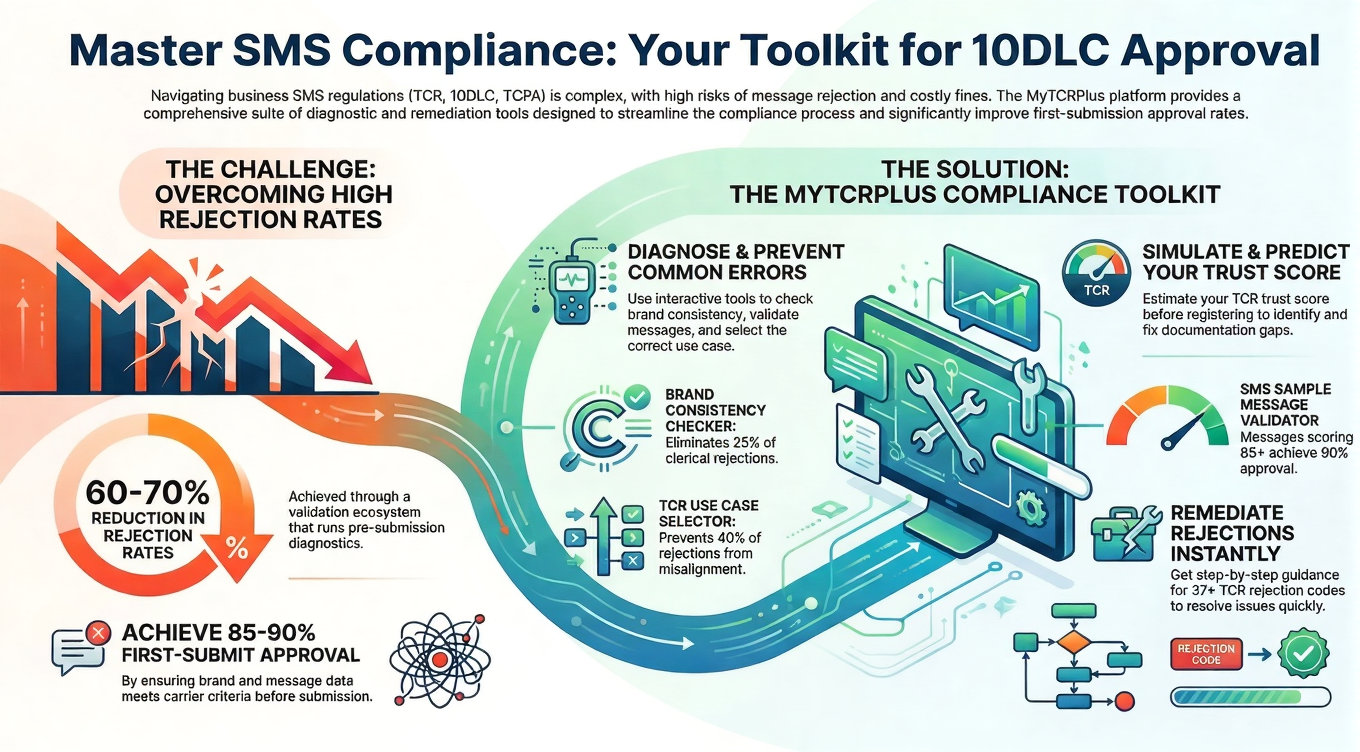

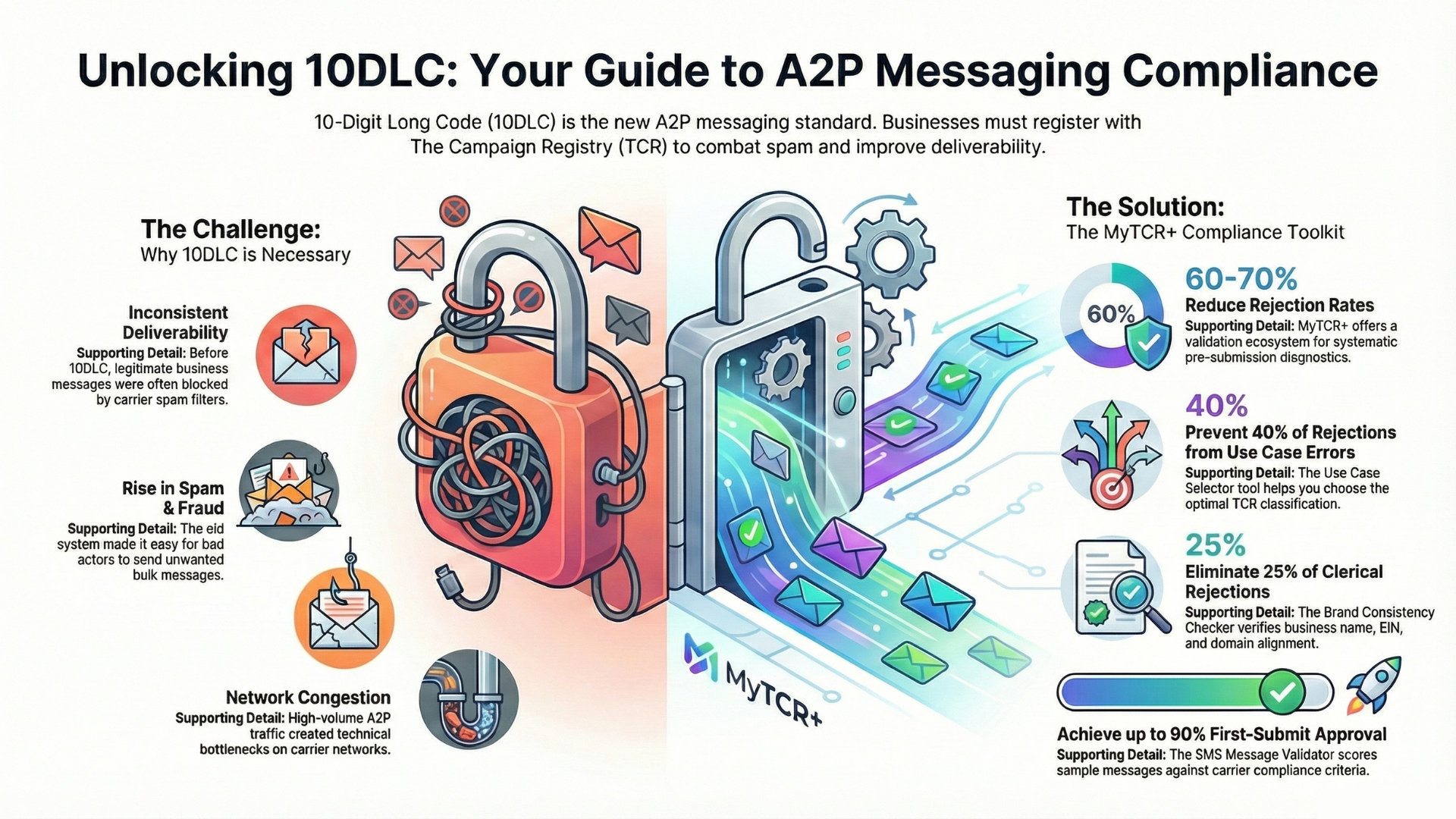

In today’s complex regulatory environment, organizations must establish robust compliance frameworks to navigate an increasingly intricate landscape of laws, regulations, and industry standards. The foundation of any successful compliance program rests on a well-structured team with clearly defined roles and responsibilities. Understanding how to organize and staff a compliance function can mean the difference between regulatory success and costly violations that can damage reputation, erode customer trust, and threaten organizational viability.

The compliance landscape has undergone dramatic transformation over the past two decades. What once might have been handled by a single compliance officer or folded into legal department responsibilities has evolved into sophisticated, multi-layered operations employing specialized professionals across various regulatory domains. This evolution reflects both the proliferation of regulations affecting modern businesses and a growing recognition that effective compliance requires dedicated resources, strategic thinking, and operational expertise that extends far beyond simple rule-following.

The Chief Compliance Officer: Strategic Leadership and Vision

At the helm of most compliance operations sits the Chief Compliance Officer, who serves as the strategic leader responsible for overseeing the entire compliance program. This executive-level position carries significant weight within the organization, reporting directly to senior leadership and often maintaining a direct line to the board of directors. The CCO establishes the compliance vision, ensures adequate resources are allocated, and acts as the primary liaison with regulatory bodies. Beyond administrative duties, this role requires someone who can balance risk management with business objectives while maintaining the independence necessary to challenge practices that may expose the organization to regulatory risk.

The effectiveness of a Chief Compliance Officer depends heavily on organizational positioning and authority. A CCO who lacks genuine influence or access to decision-makers becomes little more than window dressing, unable to effect meaningful change when compliance concerns arise. The most successful CCOs cultivate relationships across the organization, building credibility through consistent judgment, clear communication, and demonstrated business acumen that allows them to frame compliance not as a burden but as a competitive advantage and risk mitigation strategy.

The CCO role also involves significant external engagement. Regulatory relationships must be carefully managed, requiring the CCO to serve as the organization’s face during examinations, investigations, and routine interactions with oversight bodies. This external dimension demands diplomatic skills, regulatory knowledge, and the ability to advocate for the organization while maintaining transparency and credibility with regulators. A CCO who loses regulatory trust through evasiveness or misrepresentation can severely compromise the organization’s standing, while one who builds constructive relationships can sometimes negotiate more favorable outcomes during enforcement actions or policy interpretations.

Compliance Managers: Translating Strategy into Action

Supporting the CCO, compliance managers handle the day-to-day operational aspects of the program. These professionals typically oversee specific regulatory domains or business units, translating broad compliance requirements into actionable policies and procedures. They conduct regular risk assessments, develop training programs, and serve as accessible resources for employees seeking guidance on compliance matters. The compliance manager role demands both technical expertise in relevant regulations and strong interpersonal skills to effectively educate and influence behavior across the organization.

Compliance managers occupy a unique position within organizational hierarchies. They must exercise authority over compliance matters while often lacking direct supervisory control over the employees whose conduct they monitor. This requires a delicate balance of assertiveness and collaboration, establishing themselves as trusted advisors rather than enforcement police. When compliance managers become viewed as obstacles to business activity rather than partners in achieving objectives responsibly, their effectiveness diminishes considerably. The best compliance managers develop reputations for solving problems creatively, finding compliant paths forward rather than simply saying no to business initiatives.

The scope of a compliance manager’s responsibilities varies significantly based on organizational structure and industry. In financial services, a compliance manager might focus exclusively on anti-money laundering regulations, developing expertise in transaction monitoring, suspicious activity reporting, and customer due diligence requirements. In healthcare, a compliance manager might specialize in HIPAA privacy rules, Medicare billing requirements, or pharmaceutical marketing regulations. This specialization allows managers to develop deep knowledge that enables them to anticipate emerging issues and provide nuanced guidance that accounts for regulatory ambiguity and evolving interpretations.

Risk assessment represents one of the most critical functions compliance managers perform. Rather than treating all regulatory requirements as equally important, effective compliance managers identify where the organization faces the greatest exposure and allocate resources accordingly. This risk-based approach recognizes that perfect compliance across all dimensions is neither achievable nor necessary. Instead, compliance managers must exercise judgment about which risks warrant intensive monitoring and controls versus those that can be addressed through lighter-touch mechanisms. This prioritization requires understanding not just regulatory requirements but also the organization’s business model, operational realities, and risk appetite.

Compliance Analysts: The Operational Backbone

Compliance analysts form the operational backbone of the team, performing the detailed work that keeps the program running smoothly. These individuals monitor transactions, conduct investigations, analyze data for potential red flags, and maintain the documentation that demonstrates regulatory adherence. They often specialize in particular areas such as anti-money laundering, data privacy, or industry-specific regulations, developing deep expertise that allows them to identify subtle compliance issues before they escalate.

The analyst role has been transformed by technology in recent years. Where analysts once manually reviewed transactions and documents, they now increasingly work with automated monitoring systems, data analytics tools, and artificial intelligence applications that flag potential issues for human review. This technological evolution has shifted the analyst’s skill set from pure document review toward data interpretation, system configuration, and exception handling. Modern compliance analysts must be comfortable working with large datasets, understanding statistical concepts, and collaborating with IT professionals to optimize monitoring tools.

Investigation skills represent another crucial dimension of the compliance analyst role. When potential violations are identified, analysts must gather evidence, interview relevant parties, analyze documentation, and reach conclusions about whether violations occurred and what corrective actions are warranted. These investigations require objectivity, attention to detail, and the ability to document findings in ways that withstand scrutiny from regulators, auditors, or legal proceedings. Analysts must also navigate sensitive situations involving colleagues, maintaining confidentiality while pursuing facts wherever they lead.

Documentation maintained by compliance analysts serves multiple purposes beyond demonstrating regulatory adherence. These records provide the foundation for management reporting, inform strategic decisions about program enhancements, and create institutional memory that prevents repeated mistakes. Well-organized compliance documentation also proves invaluable during regulatory examinations, allowing the organization to quickly demonstrate its compliance efforts and respond to examiner requests efficiently. Conversely, poor documentation practices can turn minor compliance gaps into significant regulatory findings when organizations cannot produce evidence of their compliance activities.

Compliance Coordinators: The Connective Tissue

Many organizations also incorporate compliance coordinators who handle administrative functions, coordinate training sessions, maintain compliance calendars, and ensure that reporting deadlines are met. While this role may seem purely administrative, these coordinators often serve as the connective tissue that keeps information flowing between different parts of the compliance function. They schedule meetings, track action items, maintain policy libraries, and ensure that nothing falls through organizational cracks.

The coordinator role proves particularly valuable in larger compliance operations where multiple initiatives proceed simultaneously. Without dedicated coordination, compliance projects can languish, deadlines can be missed, and communication breakdowns can occur. Coordinators bring project management discipline to compliance work, ensuring that initiatives stay on track and that stakeholders remain informed. They also frequently serve as the first point of contact for employees with compliance questions, triaging issues and directing them to appropriate subject matter experts.

In some organizations, the compliance coordinator position serves as an entry point for compliance careers, allowing individuals to learn the regulatory landscape and organizational dynamics before advancing into analyst or management roles. This progression path helps build institutional knowledge and creates a pipeline of professionals who understand how compliance theory translates into organizational practice.

Collaborative Structure and Cross-Functional Integration

The most effective compliance teams embrace a collaborative structure rather than a purely hierarchical one. Compliance professionals must work closely with legal counsel, internal audit, risk management, and human resources to create a comprehensive control environment. This integration ensures that compliance considerations are embedded into business processes rather than treated as an afterthought. Legal teams provide regulatory interpretation and manage enforcement responses, internal audit validates control effectiveness, risk management incorporates compliance risks into enterprise frameworks, and human resources handles disciplinary actions when violations occur.

This collaborative approach extends beyond internal partnerships to include engagement with business units. Compliance teams that operate in isolation, issuing pronouncements from headquarters without understanding operational realities, quickly lose credibility and effectiveness. Forward-thinking organizations embed compliance professionals within business units or establish formal liaison relationships that create ongoing dialogue between compliance and operational teams. This integration allows compliance professionals to understand business pressures and constraints while ensuring that business leaders receive timely guidance on compliance implications of their decisions.

The relationship between compliance and internal audit deserves particular attention, as these functions sometimes struggle with role clarity and potential overlap. While both evaluate controls and identify deficiencies, compliance typically focuses on first-line prevention and monitoring while audit provides independent assurance through periodic reviews. Healthy relationships between these functions involve clear delineation of responsibilities, regular communication to avoid duplication, and mutual respect for each function’s distinct value. Dysfunctional relationships marked by territorial disputes or communication breakdowns create gaps where risks can flourish.

Adapting Team Structure to Organizational Needs

As organizations grow and regulatory demands evolve, the compliance team structure must adapt accordingly. Smaller companies might consolidate multiple functions under one or two individuals, while larger enterprises may employ dozens of specialists focused on narrow regulatory niches. Regardless of size, successful compliance teams share common characteristics: clear reporting lines, adequate authority to influence decision-making, sufficient resources to fulfill their mandate, and a culture that values ethical conduct and regulatory adherence above short-term gains.

Resource allocation for compliance functions presents ongoing challenges for organizational leadership. Compliance represents a cost center that doesn’t directly generate revenue, making it vulnerable during budget pressures. However, underinvestment in compliance capabilities creates risks that can far exceed the cost of proper staffing. A single significant regulatory violation can result in fines, legal costs, and reputational damage worth millions of dollars, dwarfing the expense of maintaining adequate compliance resources. Effective compliance leaders articulate this value proposition clearly, helping leadership understand that compliance investment represents risk mitigation rather than pure cost.

The decision whether to build compliance capabilities internally versus outsourcing certain functions represents another strategic consideration. Some organizations maintain lean internal compliance teams while contracting with specialized firms for specific functions like transaction monitoring, training development, or regulatory research. This hybrid approach can provide access to specialized expertise without the overhead of full-time employees, though it requires careful management to ensure external providers integrate effectively with internal operations and understand organizational culture and risk appetite.

Building a Culture of Compliance

Ultimately, the structure and staffing of a compliance team matter less than the culture they help create. Compliance cannot succeed through enforcement alone but requires organizational buy-in at all levels. Compliance professionals serve as culture ambassadors, modeling ethical behavior, creating safe channels for raising concerns, and ensuring that compliance expectations are clear, consistent, and reasonably achievable. When employees view compliance as a shared responsibility rather than someone else’s job, when leaders visibly support compliance initiatives, and when the organization responds to violations consistently regardless of the violator’s status, compliance becomes embedded in organizational DNA rather than remaining an external imposition.

The compliance team’s success ultimately depends on its ability to influence behavior, identify risks before they materialize, and create systems that make doing the right thing the easiest path forward. This requires professionals with diverse skills, clear organizational authority, adequate resources, and leadership commitment. Organizations that view compliance team development as strategic investment rather than regulatory burden position themselves to navigate the complex regulatory landscape successfully while building stakeholder trust and protecting long-term value.