![TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-1[1]](https://mytcrplus.com/wp-content/uploads/2026/02/TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-11-768x429.png)

![TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-2[1]](https://mytcrplus.com/wp-content/uploads/2026/02/TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-21-768x429.png)

![TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-3[1]](https://mytcrplus.com/wp-content/uploads/2026/02/TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-31-768x429.png)

![TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-4[1]](https://mytcrplus.com/wp-content/uploads/2026/02/TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-41-768x429.png)

![TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-5[1]](https://mytcrplus.com/wp-content/uploads/2026/02/TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-51-768x429.png)

![TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-6[1]](https://mytcrplus.com/wp-content/uploads/2026/02/TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-61-768x429.png)

![TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-7[1]](https://mytcrplus.com/wp-content/uploads/2026/02/TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-71-768x429.png)

![TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-8[1]](https://mytcrplus.com/wp-content/uploads/2026/02/TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-81-768x429.png)

![TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-9[1]](https://mytcrplus.com/wp-content/uploads/2026/02/TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-91-768x429.png)

![TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-10[1]](https://mytcrplus.com/wp-content/uploads/2026/02/TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-101-768x429.png)

![TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-11[1]](https://mytcrplus.com/wp-content/uploads/2026/02/TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-111-768x429.png)

![TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-12[1]](https://mytcrplus.com/wp-content/uploads/2026/02/TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-121-768x429.png)

![TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-13[1]](https://mytcrplus.com/wp-content/uploads/2026/02/TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-131-768x429.png)

![TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-14[1]](https://mytcrplus.com/wp-content/uploads/2026/02/TCR_Compliance_Budget_Planning_2025_Comprehensive_Cost_Analysis_Guide_slide_deck_-_no_wm-141-768x429.png)

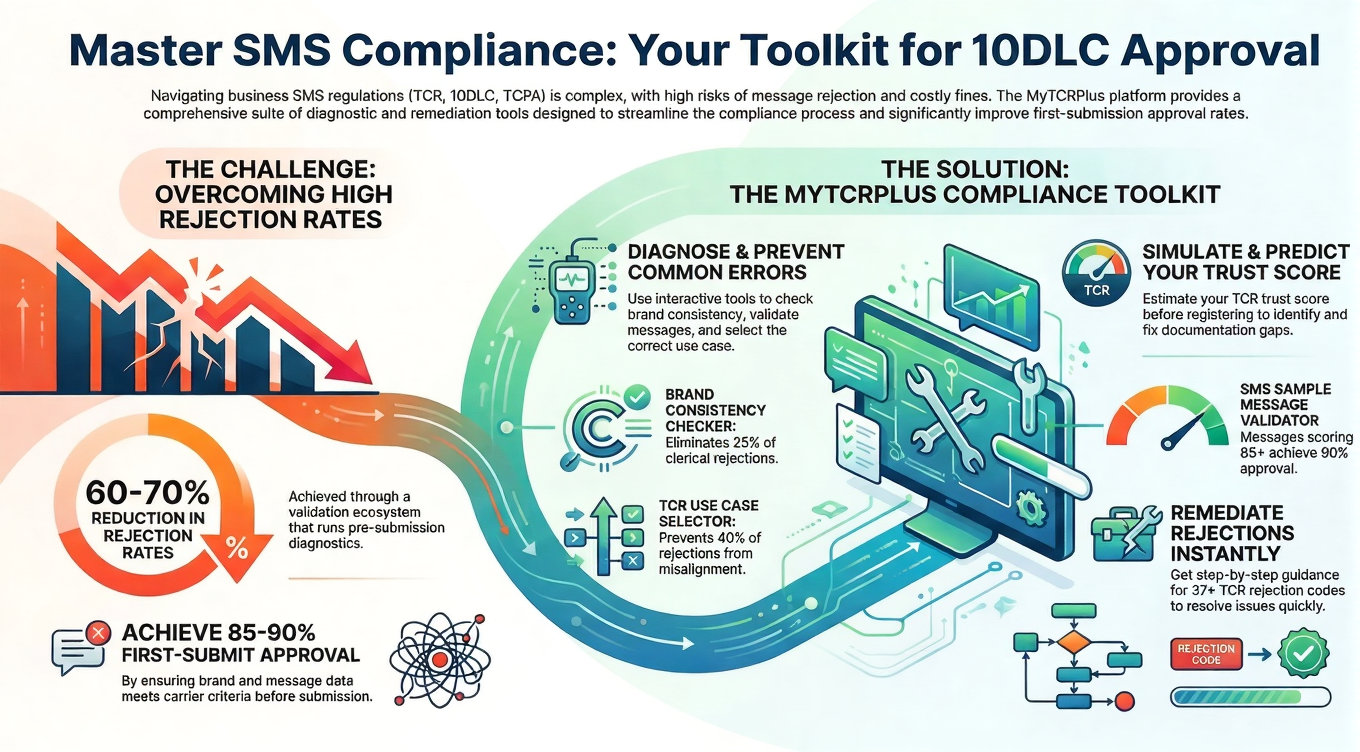

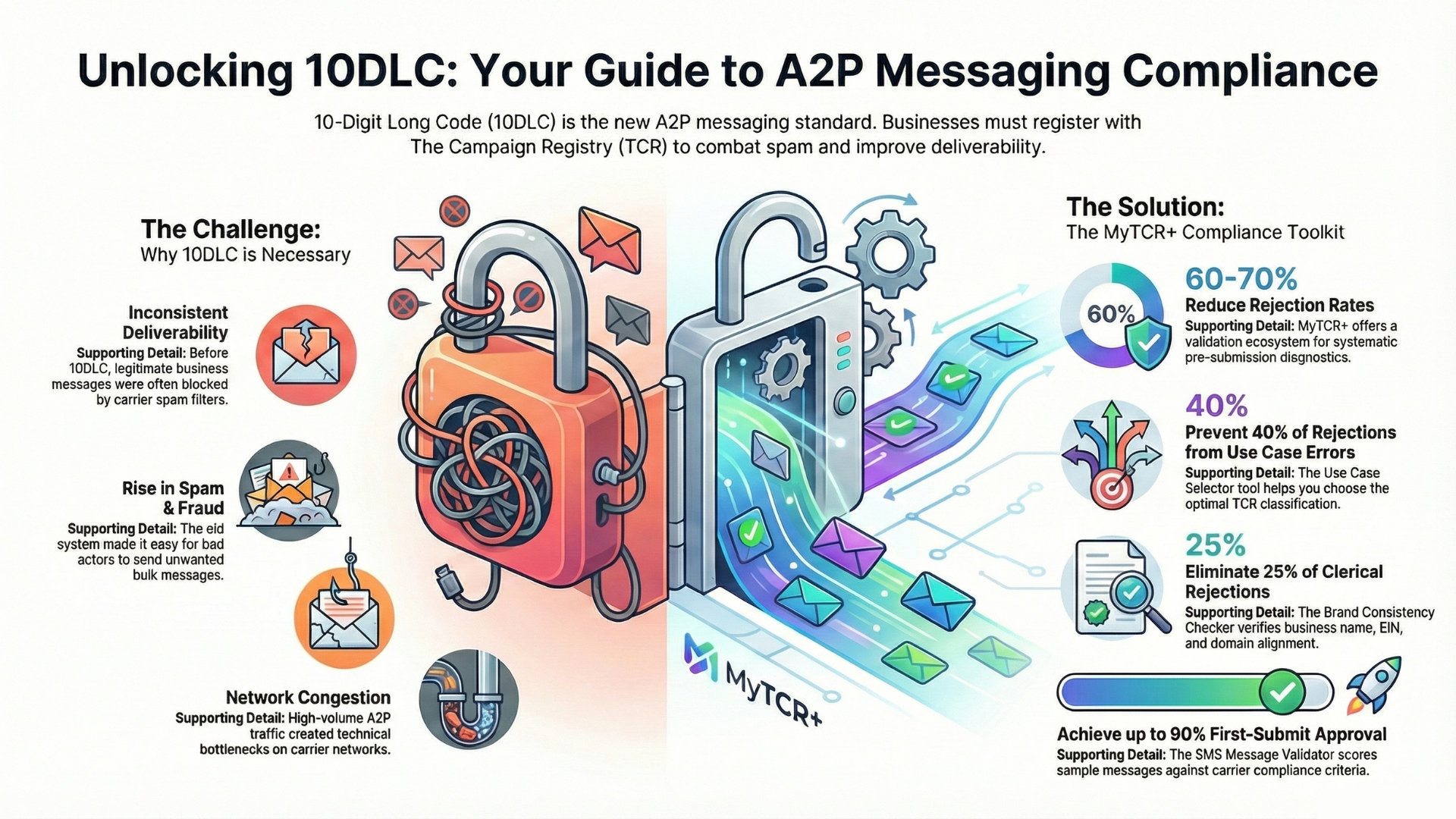

As we move deeper into 2025, businesses utilizing Application-to-Person (A2P) messaging must confront the financial realities of The Campaign Registry (TCR) compliance. What began as a regulatory framework to combat spam and fraud has evolved into a mandatory cost center that requires careful budget planning, strategic resource allocation, and sophisticated financial modeling. For many organizations, understanding and managing TCR compliance costs has become as critical as managing any other operational expense. This comprehensive guide walks through the various cost components, helps you calculate your organization’s likely expenses, and provides strategies for optimizing your TCR investment throughout the year.

The Evolution of TCR from Regulatory Framework to Business Expense

The Campaign Registry emerged in response to a critical need within the telecommunications industry. Major wireless carriers recognized that spam, fraud, and unregistered messaging campaigns were degrading the SMS channel and creating poor customer experiences. By implementing TCR, the telecommunications industry created a verification system designed to authenticate legitimate businesses and campaigns while blocking or degrading service for suspicious or non-compliant senders.

For businesses, this regulatory framework translated into a new cost structure that didn’t exist before. Unlike some compliance measures that businesses can manage primarily through policy and process changes, TCR compliance requires direct financial investment. The costs are recurring, scale with business volume, and in many cases are mandatory rather than optional. Understanding these costs has become essential for accurate financial planning, particularly for organizations that rely heavily on SMS marketing, customer notifications, or two-way messaging.

The urgency of TCR compliance budgeting in 2025 stems from the maturing implementation of these requirements. Early adopters had time to experiment and adjust their approaches. Organizations that delayed compliance face more immediately pressing decisions about budget allocation and implementation timelines. Whether you’re planning your first TCR investment or optimizing an existing program, having clear visibility into the cost structure is essential.

Breaking Down TCR Registration Costs: The Foundation of Your Budget

The foundation of TCR compliance costs starts with registration fees, which vary significantly based on your business structure, entity type, and messaging volume. Understanding these foundational costs is the first step toward building an accurate budget.

For standard brands and established businesses, the one-time brand registration fee is typically approximately $4. This modest initial investment represents the basic entry point into the TCR ecosystem. However, sole proprietors, freelancers, and individual business owners encounter substantially higher costs ranging from $15 to $40 for brand registration. This pricing structure reflects the additional verification work required for smaller entities and individuals who may have less established business infrastructure or public presence.

The real financial commitment emerges when brands seek to establish credibility and improve delivery rates through Trust Score verification. The verification process involves TCR evaluating your business documentation, verification of legitimate business operations, assessment of messaging practices, and evaluation of compliance history. This verification assessment translates into meaningful cost differentials.

Low-volume verification, typically appropriate for businesses sending fewer than one million messages annually, runs between $40 and $50 as a one-time or annual cost depending on your TCR provider. This level of verification provides moderate Trust Score improvements and demonstrates basic legitimacy to carriers. For many small and mid-market businesses, this verification tier represents a reasonable balance between compliance investment and messaging volume.

High-volume verification, designed for enterprises sending millions of messages monthly, can reach up to $4,000 annually. This substantial investment provides significant Trust Score elevation, enhanced brand credibility, and substantially reduced per-message carrier fees. While the cost appears steep in isolation, for large-volume senders, this investment often provides rapid return through reduced message costs and improved delivery rates.

The distinction between low-volume and high-volume verification creates an important strategic decision point in your budget planning. Organizations need to carefully assess their actual messaging volumes, growth trajectories, and the financial impact of different verification levels. A business projecting rapid growth may find that investing in high-volume verification upfront, even if current volumes don’t strictly require it, produces better long-term financial outcomes.

Campaign Registration: Managing Recurring Costs Across Multiple Initiatives

Campaign registration adds another distinct layer to the TCR compliance budget equation that many organizations underestimate initially. Each campaign—where a campaign represents a specific messaging initiative with defined content, audience, and purpose—requires its own registration in the TCR system. These aren’t one-time fees; they recur on a monthly basis, creating ongoing obligations that must be factored into your regular operating expenses.

Individual campaign registration fees generally range from $10 to $15 per campaign per month. While this seems modest for a single campaign, the mathematics become significant quickly for organizations managing multiple messaging initiatives. Consider the typical structure of a mid-sized enterprise: a promotional campaign for new product launches, a customer service campaign for account notifications, a transactional campaign for order confirmations, a loyalty program messaging campaign, a payment reminder campaign, and specialized campaigns for different business units or customer segments.

A mid-sized enterprise running ten distinct campaigns could face monthly recurring expenses of $100 to $150 solely for campaign maintenance fees, which translates to $1,200 to $1,800 annually before accounting for any per-message volume charges. For larger enterprises with dozens of campaigns spanning different business units, brands, or geographic markets, these costs can accumulate to thousands of dollars monthly.

This campaign cost structure creates important strategic implications for how organizations structure their messaging operations. Some businesses consolidate multiple related messaging initiatives into single campaigns to minimize registration costs. Others maintain separate campaigns to preserve clear analytics and campaign tracking. The financial implications of these structural choices should be considered deliberately rather than defaulting to whatever structure feels most natural from an operational perspective.

Campaign registration costs also increase if organizations modify existing campaigns or create new ones throughout the year. Plans that account for potential campaign expansion—whether for seasonal promotions, new product launches, business expansion, or new customer acquisition initiatives—should include budget allocation for these additional registrations.

Understanding Mobile Carrier Pass-Through Fees: The Most Variable Cost Component

The mobile carrier pass-through fees represent perhaps the most unpredictable and variable element of TCR compliance budgeting, yet they often constitute the largest expense component for organizations with substantial messaging volumes. These are per-message fees that major carriers assess for processing and delivering A2P SMS traffic, and they fluctuate based on your brand’s Trust Score, campaign type, messaging volume, and carrier-specific policies.

Brands with strong Trust Scores and established compliance histories enjoy competitive per-message rates as low as $0.002 per message. For context, this means sending 100,000 messages would incur approximately $200 in carrier fees. These favorable rates reward businesses that have invested in verification, maintained compliance, and demonstrated legitimate messaging practices.

Conversely, brands with lower Trust Scores, unverified status, or recent compliance violations face substantially higher per-message fees ranging between $0.003 and $0.01 per message. For the same volume of 100,000 messages, this creates a range of $300 to $1,000 in carrier fees—representing a potential variation of 400 percent based solely on Trust Score status.

To illustrate the financial magnitude of carrier fees, consider different business scenarios. A small business sending 10,000 messages monthly at a $0.005 per-message average rate would face approximately $50 in monthly carrier fees, or $600 annually. A mid-market business sending 500,000 messages monthly would pay approximately $2,500 monthly or $30,000 annually. A large enterprise sending 5 million messages monthly could face $25,000 monthly or $300,000 annually in carrier fees alone.

The substantial variation in per-message costs creates powerful financial incentives to achieve and maintain higher Trust Scores. Even modest improvements to your Trust Score can translate into significant savings that compound across millions of messages. A business that reduces its per-message cost from $0.008 to $0.004 through improved Trust Score saves $2,000 per month on one million messages—$24,000 annually on a single basis point improvement.

This cost structure also means that carrier fee predictions require understanding your organization’s likely messaging volumes, growth patterns, and Trust Score trajectory. Conservative budget planning should account for higher per-message rates initially, with the understanding that investments in verification and compliance may reduce these rates over time, creating favorable variance against budget.

Operational and Infrastructure Costs: The Hidden TCR Expense Components

Beyond the direct fees paid to TCR and carriers, organizations must account for the operational overhead and infrastructure investments required to maintain effective TCR compliance. These often-overlooked costs can represent a substantial portion of total TCR expense for organizations that haven’t built compliance processes into their existing operations.

Staff time and human resources constitute a significant operational cost. Someone within your organization needs to monitor campaign performance against carrier guidelines, investigate delivery issues that might relate to compliance, update registrations when business operations change, manage the TCR dashboard and reporting, track Trust Score status, and ensure ongoing adherence to carrier policies and compliance requirements. Depending on your organization’s size and complexity, this might represent 10-30 percent of a compliance professional’s time, or full-time dedication for larger organizations. When multiplied by the salary, benefits, and overhead costs associated with that staff time, the annual cost can easily reach five figures.

Technical infrastructure represents another significant investment category. Organizations must integrate with TCR-compliant messaging platforms, which may require selecting new vendors if existing platforms don’t support TCR compliance, paying integration fees, implementing API connections, building messaging workflows, and ensuring compliance monitoring is automated rather than manual. If internal technical resources lack the necessary expertise, organizations may need to engage external consultants or development partners to implement these systems. Professional services costs for TCR implementation can range from $5,000 for straightforward deployments to $50,000 or more for complex integrations across multiple systems.

Ongoing vendor support and platform fees also contribute to operational costs. Premium messaging platforms often charge monthly fees based on messaging volume or account tier. Compliance monitoring tools may require separate subscriptions. Customer support and integration support services add additional expenses. While individual vendor fees might seem modest, when aggregated across multiple tools and platforms required to maintain TCR compliance, they can reach hundreds of dollars monthly.

Quality assurance and testing represent additional often-overlooked costs. As organizations implement TCR compliance, they need to test messaging workflows, validate that compliance controls are functioning correctly, and verify that messages are being delivered appropriately. Testing across different carriers, message types, and customer segments requires time, resources, and potentially external tools or services.

Documentation and training costs round out the operational expense picture. Staff members need training on TCR requirements, company policies around compliance, and their specific responsibilities in maintaining compliance. Documentation needs to be created and maintained. These costs might seem modest but represent real expenses that should be reflected in budgets.

Strategic Considerations: When to Invest in Enhanced Verification

Many organizations initially register with basic verification but later discover that elevated Trust Scores significantly reduce per-message costs and improve delivery rates. This creates an important strategic decision point: should you invest upfront in high-volume verification even if your current messaging volumes don’t strictly require it, or should you start with basic verification and upgrade later if needed?

The answer depends on several factors. If you’re projecting substantial growth in messaging volume, the math often favors upfront investment in higher verification. The savings in per-message costs across millions of messages can exceed the verification investment within months. If you’re maintaining relatively stable messaging volumes, starting with lower verification and upgrading based on demonstrated need might be more prudent.

However, high-volume verification provides benefits beyond immediate cost savings. Higher Trust Scores improve message deliverability, meaning your messages are more likely to reach recipient inboxes rather than being filtered or delayed. This improved deliverability can have meaningful business impacts that aren’t captured in the direct cost analysis. Messages that reach inboxes drive better engagement rates, higher conversion rates on marketing campaigns, and more reliable delivery of critical transactional and customer service messages.

Additionally, building Trust Score is not an instantaneous process. When you first achieve high-volume verification, your Trust Score may still take time to climb as carriers evaluate your ongoing compliance record. Starting this process earlier rather than later means your messages benefit from elevated Trust Score sooner.

Organizations should evaluate their verification strategy as part of overall budget planning, considering both immediate costs and long-term financial and operational implications.

Accounting for Non-Compliance Costs and Risk Mitigation

Finance teams should also prepare for the possibility of penalty costs and deliverability impacts associated with non-compliance or campaign violations. While budget planning naturally focuses on expected, anticipated costs, responsible financial planning accounts for potential adverse scenarios.

Carriers are increasingly enforcing strict content guidelines, and violations can result in campaign suspensions, brand flagging, rate limiting, or increased fees that compound over time. A serious compliance violation could result in temporary suspension of messaging capabilities, requiring rapid remediation and potentially impacting business operations. More frequently, violations result in gradual degradation of Trust Score, which increases per-message costs and reduces deliverability without dramatic disruption.

Insurance and contingency reserves for these scenarios represent prudent risk management. Many organizations allocate 10-15 percent of their anticipated TCR budget as a contingency pool to cover unexpected costs, accelerated remediation expenses, or increased rates resulting from compliance issues. While this contingency might not be needed, having it available prevents TCR budget overruns from disrupting other business objectives.

Additionally, organizations should consider the business costs associated with deliverability problems resulting from non-compliance or poor Trust Score. A marketing campaign that generates poor engagement due to messages not reaching inboxes has cost the organization not just the TCR fees but also the expected marketing impact. Transactional messages that are delayed due to filtering can result in customer service issues and support costs. These indirect costs, while difficult to quantify precisely, often dwarf the direct TCR compliance expenses.

Building a Comprehensive 2025 TCR Budget

Building an effective TCR compliance budget for 2025 requires consolidating the various cost components and creating a structured financial plan. A typical budget framework should include:

Registration and Verification Costs: Calculate your brand registration fee, determine the appropriate verification level based on messaging volume and growth projections, and identify the annual or one-time costs associated with your chosen verification level.

Campaign Registration Costs: Inventory all messaging campaigns planned for 2025, account for monthly recurring fees for each campaign, and project any additional campaigns that might be added during the year.

Carrier Pass-Through Fees: Estimate your monthly messaging volume, research current per-message rates for brands at your anticipated Trust Score level, and calculate total carrier fees. Build in sensitivity analysis that shows how costs would change if your Trust Score improves or if messaging volumes grow beyond projections.

Operational and Infrastructure Costs: Allocate staff time required for compliance monitoring and management, identify technology platforms and vendor costs, estimate professional services needed for implementation or integration, and account for training and documentation costs.

Contingency and Risk Mitigation: Add 10-15 percent of total anticipated costs as a contingency reserve for unexpected expenses, compliance remediation, or Trust Score improvement investments.

Quarterly Review Schedule: Plan for quarterly reviews of actual spending versus budget, monitoring of messaging volumes and Trust Score trends, and adjustment of projections based on business performance and platform changes.

Optimization Strategies for Maximizing TCR Investment Value

Beyond simply accounting for costs, organizations should develop strategies for optimizing their TCR investment and ensuring they receive maximum value from their compliance spending.

Consolidating messaging initiatives where appropriate can reduce overall campaign registration costs. Rather than maintaining separate campaigns for closely related messaging, consolidation reduces per-campaign fees while maintaining the necessary operational tracking and analytics.

Monitoring and improving Trust Score proactively reduces per-message costs over time. Organizations should track their Trust Score monthly, identify factors that influence it, and make deliberate investments in compliance and verification that improve it. Even modest Trust Score improvements can generate substantial savings across high-volume messaging.

Regular carrier relationships and communications help organizations understand how their Trust Score is evaluated, what factors influence it, and what actions most effectively improve it. Some carriers offer specific guidance about compliance practices that improve Trust Score more effectively than others.

Optimizing message volume through better targeting and segmentation ensures you’re only sending messages to engaged audiences who want to receive them. This reduces total message volume, decreases carrier fees, and improves engagement metrics—creating a triple benefit of reduced costs, better performance, and improved customer experience.

The Bigger Picture: TCR Investment as Strategic Infrastructure

While TCR compliance can feel like an imposed compliance burden, it’s important to recognize that these costs represent investment in critical communications infrastructure. The TCR framework, despite its costs, actually benefits legitimate businesses by distinguishing them from spammers and fraudsters. Organizations that invest in TCR compliance and achieve strong Trust Scores benefit from improved deliverability, better customer engagement, and reduced risk of reputation damage from association with spam.

The key to effective TCR compliance budgeting lies in treating it not as a static, fixed expense but as a dynamic component of your communications infrastructure that evolves with your business. Regular quarterly reviews of messaging volumes, Trust Score status, campaign performance, and cost drivers will help organizations optimize their TCR investment while maintaining robust regulatory compliance throughout 2025 and beyond.

Finance teams that approach TCR budgeting strategically—understanding cost drivers, planning for growth, investing in Trust Score, and monitoring performance—position their organizations to maintain compliance efficiently while maximizing the business value of their messaging channels. In the increasingly regulated world of A2P messaging, this strategic approach to compliance investment often becomes a competitive advantage, distinguishing well-managed organizations from those struggling with deliverability problems, compliance violations, and escalating costs.